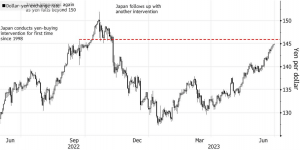

The Japanese currency continues to lose its strength. The yen fell to the level of 145 against the dollar, which is the lowest level in the past 8 months. This level approaches the point at which Japan took measures to support the value of its currency for the first time since 1998.

While global currency markets pay increasing attention to differences in monetary policy, the yen declined by 0.2% to the level of 145.07. This was a result of renewed interest in the divergences between Japan and its major competitors in East Asia.

One of the reasons putting pressure on the yen is the growing gap between the accommodative monetary policy of Japan and the more hawkish approach of other countries, including the US Federal Reserve. Analysts consider the level of 145 to be an important point for Japanese officials to consider. The rise in global yields also favors other currencies, while negative interest rates persist in Japan.

Forecasts indicate that the Japanese authorities may take limited market intervention measures in the coming weeks to maintain a certain level of uncertainty among speculators. Most experts believe that Japan understands that the rise in US yields compared to the cautious policy of the Bank of Japan is a factor contributing to the depreciation of the yen.

Despite the current weakness of the yen, policymakers and business leaders show a more optimistic attitude toward this decline compared to last year’s crash, indicating that they view this decline as a temporary phenomenon. In the past year, Japan already engaged in active direct purchases of the yen amounting to 65 billion dollars to raise its exchange rate from historical lows against the US dollar.