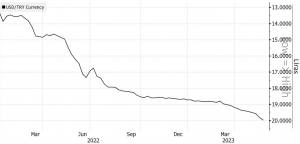

The Turkish lira continues to weaken after Recep Tayyip Erdogan’s victory in the elections. The lira exchange rate has dropped by 0.4% to 20.05 against the US dollar. Analysts predict further currency depreciation: Morgan Stanley warns that by the end of the year, the exchange rate could fall by 29% to 28 lira per dollar if Erdogan does not change his policy. Erdogan’s victory has not reassured foreign investors, as high inflation, low interest rates, and insufficient currency reserves could lead to a severe crisis.

The lira began its decline in 2012, and this trend continues to this day. The main factor behind this decline has been Erdogan’s unorthodox approach to interest rates. Markets have become dependent on unpredictable rules and interventions. Investors face uncertainty and lack of confidence, which negatively affects the Turkish currency. Since 2013, the volume of foreign assets in Turkish stocks and bonds has decreased by 85%, amounting to nearly $130 billion.

Burak Cetinceker, a money manager at Strateji Portfoy in Istanbull, stated that the current economic model is ineffective. He suggests that a transition to orthodox policies will likely be made in the near future to avoid becoming unsustainable. The market welcomes any signal in this direction.