Many would like to trade in financial markets: buy and sell stocks, currency, and precious metals. However, without an intermediary, namely a broker, investors and traders cannot get direct access to the market. The solution is to open a brokerage account, which provides the user access to financial markets.

In this article, you’ll find out where to open a brokerage account, which account type to choose, and how to withdraw your profit.

What is a Brokerage Account?

A brokerage account (BA) is a special account to trade securities, commodities, metals, stocks, bonds, indices, and currency. It is opened with a broker, who acts as the intermediary between the private investor and the marketplace.

How is a Brokerage Account Different from a Regular One?

A brokerage account is similar to a bank account. Unlike a bank account, the BA provides access to trading in financial markets. The BA stores the trader or investor’s funds and displays information about acquired assets.

Advantages of a Brokerage Account:

- Access to a variety of financial instruments. You can tap into a wide range of financial instruments like stocks, bonds, indices, currency pairs, commodities, metals, and cryptocurrencies.

- Financial independence. With a brokerage account, you have the freedom to trade in real-time and manage your capital on your terms.

- Security. Opening a brokerage account with a reputable bank or brokerage firm ensures the safety of your funds, offering peace of mind.

- Convenience. You can easily open brokerage accounts online, eliminating the need for in-person visits. This flexibility allows you to trade and manage your finances from anywhere in the world, at any time of day.

Types of Brokerage Accounts

There are two main types of brokerage accounts:

1. Standard Brokerage Account – an account opened with a broker. There are no restrictions on the deposit amount. There are no tax benefits. A user can open multiple BAs.

2. Individual Investment Account (IIA) – opened either with a broker or an asset management company. Users can expect to receive income tax deductions, but the account top-up amount is limited. Moreover, a user can only open one IIA.

Difference between BA and IIA

In a nutshell, IIA is for savings, while BA is for daily trading.

Both account types allow for trading in financial markets. IIA accounts are tailored for users with taxable income who aim to boost their returns from long-term investments by leveraging tax deductions. On the other hand, BA accounts do not provide tax benefits but offer greater flexibility in terms of depositing and withdrawing funds.

How to Open a Brokerage Account

To open a brokerage account, you must choose a reliable bank or brokerage firm, register, and provide all necessary documents, such as a passport or driver’s license. Opening a BA is free. Next, you deposit funds into the BA and start trading.

Choosing a Broker When Opening an Account

When choosing among several online brokers, you should consider the following:

- Broker’s experience: Take note of how long the broker has been providing services.

- Geographical reach: Check the countries where the broker offers its services.

- Trustpilot rating: Check the broker’s rating on Trustpilot, one of the few platforms publishing genuine user reviews and ratings these days.

- Participation in exhibitions: Find out whether the broker actively participates in international exhibitions.

- Regulatory oversight: Check which authorities regulate the broker’s operations to ensure they comply with established standards and regulations.

Brokerage Account Overview

Say, you’ve picked your broker. However, when you visit the company’s website, you may find it hard to choose a type of a brokerage account (BA).

Most brokers offer the opportunity to open both a demo account and a live account.

A demo brokerage account is a trading simulator with the same features and trading conditions as a live account. It’s an excellent tool that allows novice traders to practice without losing money, and experienced traders to test new strategies without any risk.

A live account allows traders to trade real assets and earn actual profits. But don’t rush to start trading on a live account. First, hone your skills on the demo and, once you’re confident, switch to a live account.

Types of Live Brokerage Accounts

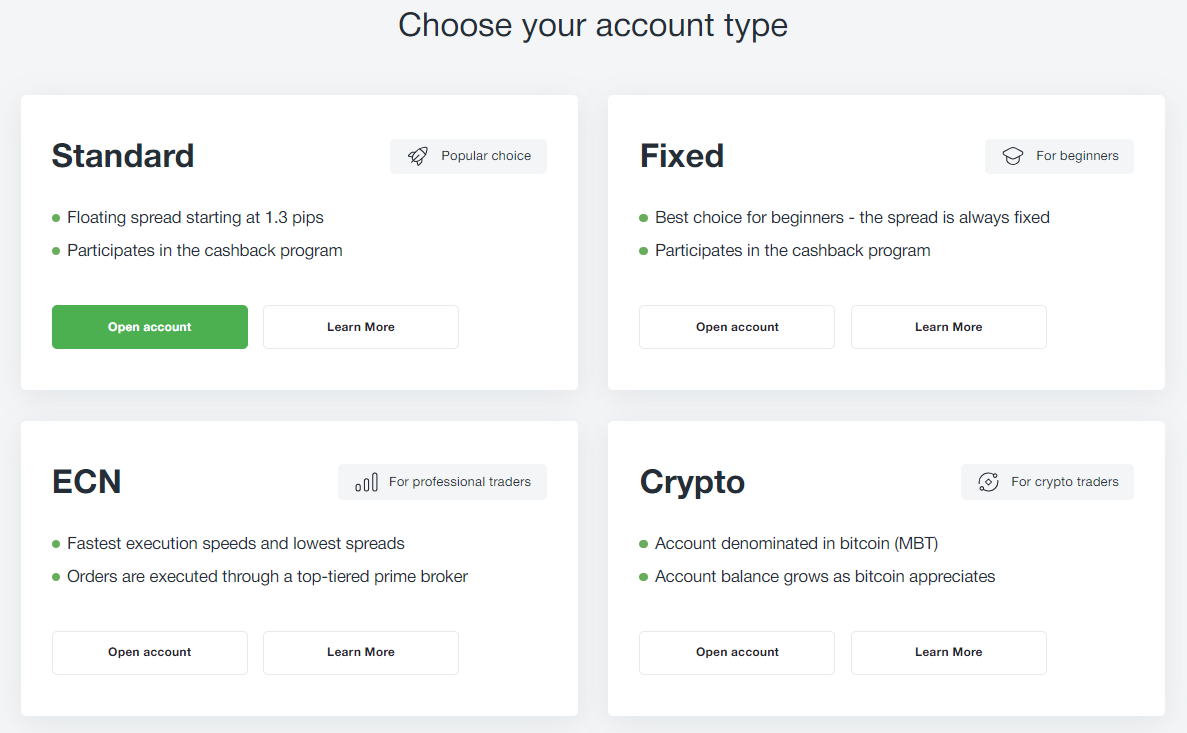

Brokers offer their clients several types of trading accounts to choose from. While all these accounts grant access to financial markets, they vary in their trading conditions.

Let’s examine the types of brokerage accounts provided by an international online broker to understand their differences:

Standard – This is the most popular account type, a classic that each broker interprets differently. Typically, accounts of this type have a floating spread and no commission on order openings.

Fixed – This type of account is often chosen by those who prefer positional trading because it has a fixed spread, and the trader pays a fixed amount for each transaction.

ECN – Unlike the first two account types that cater to traders of all levels, an ECN account demands a higher level of expertise. ECN accounts are ideal for scalping thanks to their lightning-fast order execution and tight spreads.

Crypto – Such accounts are denominated in cryptocurrency, typically in MBT (1/1000 BTC). The trading conditions are similar to those of a Standard account (floating spread and zero fees to open a trade).

Minimum Deposit Requirements

The minimum deposit amount depends on the bank or brokerage firm, but it’s typically starting from $100.

How to Withdraw Funds from a Brokerage Account

With an online broker, you can withdraw funds in a way that’s convenient for you, using any available payment method offered by the broker. Often, such a withdrawal from the brokerage account can be commission-free. There are several withdrawal options:

- Bank cards.

- Bank transfers.

- Cryptocurrency wallets.

- Electronic payment systems.

When someone tries to withdraw money from a brokerage account, they usually face taxes. It’s your right and duty as a law-abiding citizen to pay tax on your brokerage account. You need to find out precisely which taxes you need to pay upon withdrawal from your tax inspector.

How to Close a Brokerage Account

It all depends on where you opened the brokerage account: in a bank or with a broker. Some banks require in-person presence to close a BA, while others offer the option to close the BA online.

Most online brokers allow clients to archive their BA through their personal dashboard. If there’s no trading activity and funds on the archived account for 6 months, the account will be automatically deleted.