The Turkish lira is facing significant pressure due to political uncertainty. Traders are bracing for potential market volatility. President Recep Tayyip Erdogan is likely to meet opposition candidate Kemal Kilicdaroglu in the second round of elections on May 28. Both candidates failed to secure the necessary 50% of votes on Sunday. After counting over 98% of the votes, Erdogan received 49.3% while Kilicdaroglu gained 45%.

Ogeday Topcular, a money manager at RAM Capital SA, stated that if the results remain unchanged, it would be one of the worst outcomes for the market, which can expect uncertainty in the coming weeks.

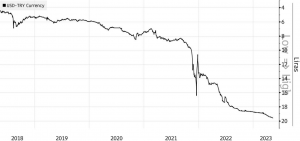

The situation with the Turkish lira has deteriorated since 2018 when Erdogan implemented unconventional measures, including lowering interest rates to stimulate growth, controlling the exchange rate, and state intervention, despite sharp inflationary pressures.