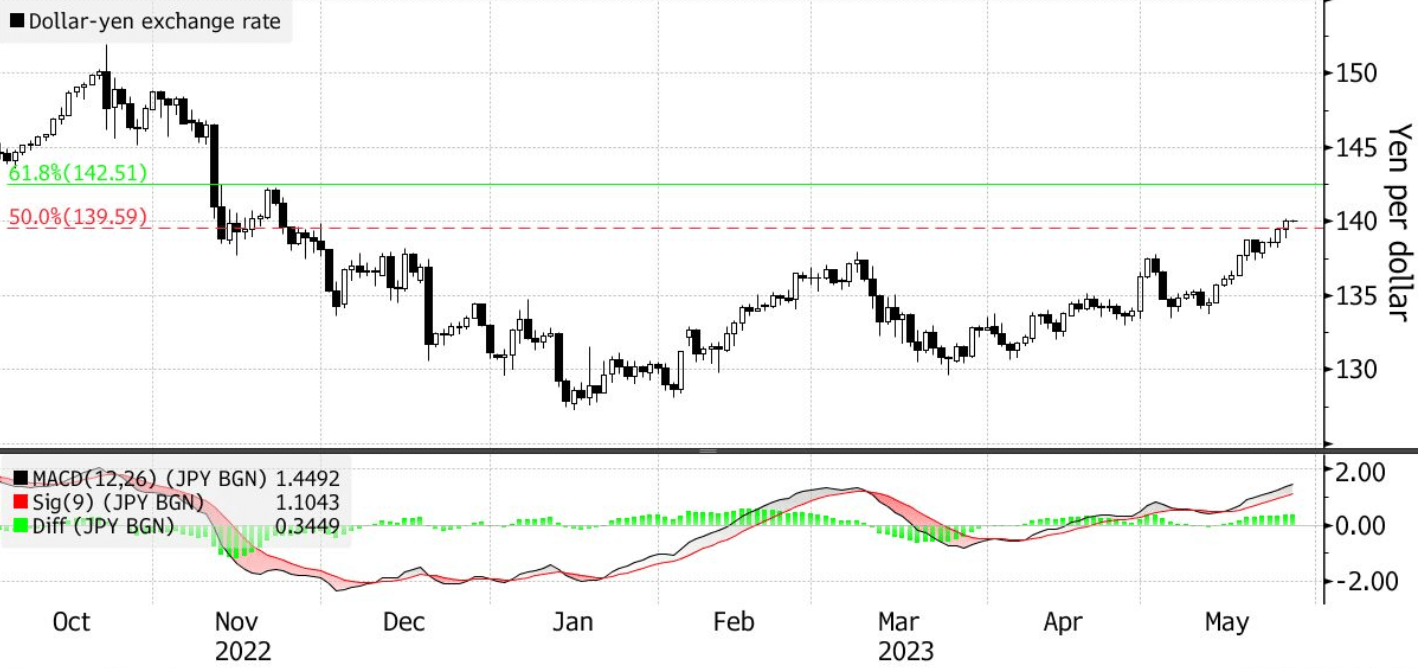

The yen reached its lowest level since November 23, dropping to 140.23 on Thursday. However, it made a slight recovery and traded 0.2% higher at 139.82 on Friday. For the current year, the yen has depreciated by 6.2% against the dollar.

Bipan Rai, a currency strategist at Canadian Imperial Bank of Commerce, notes that the yen’s decline to the level of 140 is more influenced by the dynamics of the dollar rather than the yen’s own factors.

Brad Bechtel, a foreign-exchange strategist at Jefferies, points out that the strengthening of the dollar against the yen is a typical occurrence. He predicts a possible level of 143 to be reached next week.

Many traders anticipate a 0.25% increase in the interest rate by the US Federal Reserve in the next two meetings and consider the likelihood of this hike happening as early as the following month. Meanwhile, the Bank of Japan aims to maintain its flexible monetary policy. Kazuo Ueda, the Governor of the Bank of Japan, has repeatedly emphasized his intention to continue the accommodative policy without tying it to wages or specific economic indicators. He also does not exclude the possibility of policy adjustments even if inflation remains below the target level of 2%.