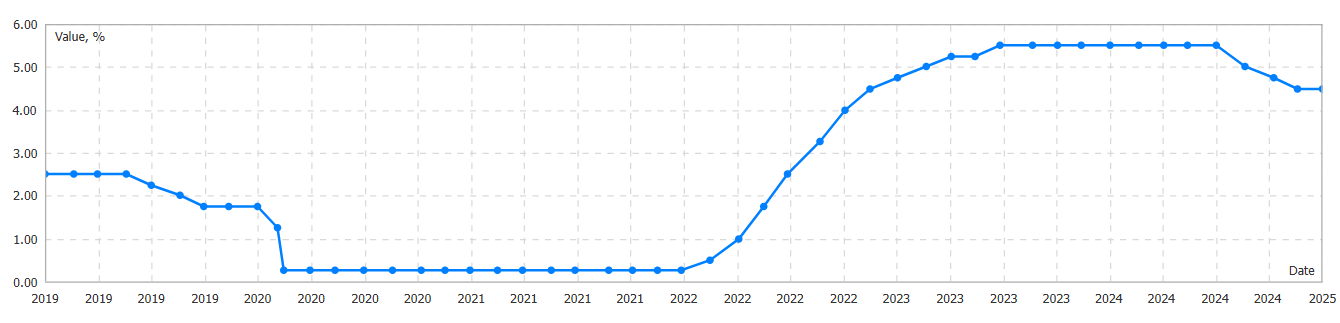

The FOMC meeting on Wednesday, January 29, did not change monetary policy, as Fed voting members decided to keep the rate at 4.50%. Market participants expected this outcome, as the CME Group FedWatch tool had indicated a 0% probability of an interest rate change in January. The focus shifted to the FOMC press conference, where traders and investors anticipated new comments from Fed Chair Jerome Powell.

The rhetoric of the speech remained largely unchanged from December 2024, as Jerome Powell reaffirmed a cautious approach to monetary policy normalization. However, minor tweaks were introduced, reassuring financial markets about the Fed’s “more hawkish” stance.

Instead of stating that “inflation has made progress toward the Committee’s two percent objective but remains somewhat elevated,” the Fed Chair mentioned only that “inflation remains somewhat elevated.” They now say, “The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid.” In contrast, the previous meeting noted, “Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low.”

Although these modest adjustments have significantly influenced market sentiment, they sound more hawkish than the FOMC’s December 2024 announcement. As for the rest of the speech, there was nothing new to highlight. The Fed remains patient regarding interest rate normalization, as Jerome Powell emphasized that the central bank has no “need to be in a hurry to adjust our policy stance.”

When directly asked about the next meeting in March, Powell avoided giving a direct answer but stated that they expect disinflation to continue along a “broad and bumpy path.” According to him, there is no need to make any adjustments at the March meeting.