Oil prices are falling due to the escalation of the US debt ceiling situation and Russia’s statements about intending to reduce oil production within OPEC+.

It is anticipated that during the upcoming meeting in June, OPEC+ and its allies will not take new measures to reduce production, as stated by Russian Deputy Prime Minister Alexander Novak in an interview with “Izvestiya.” This will mark the organization’s first in-person gathering in the past six months.

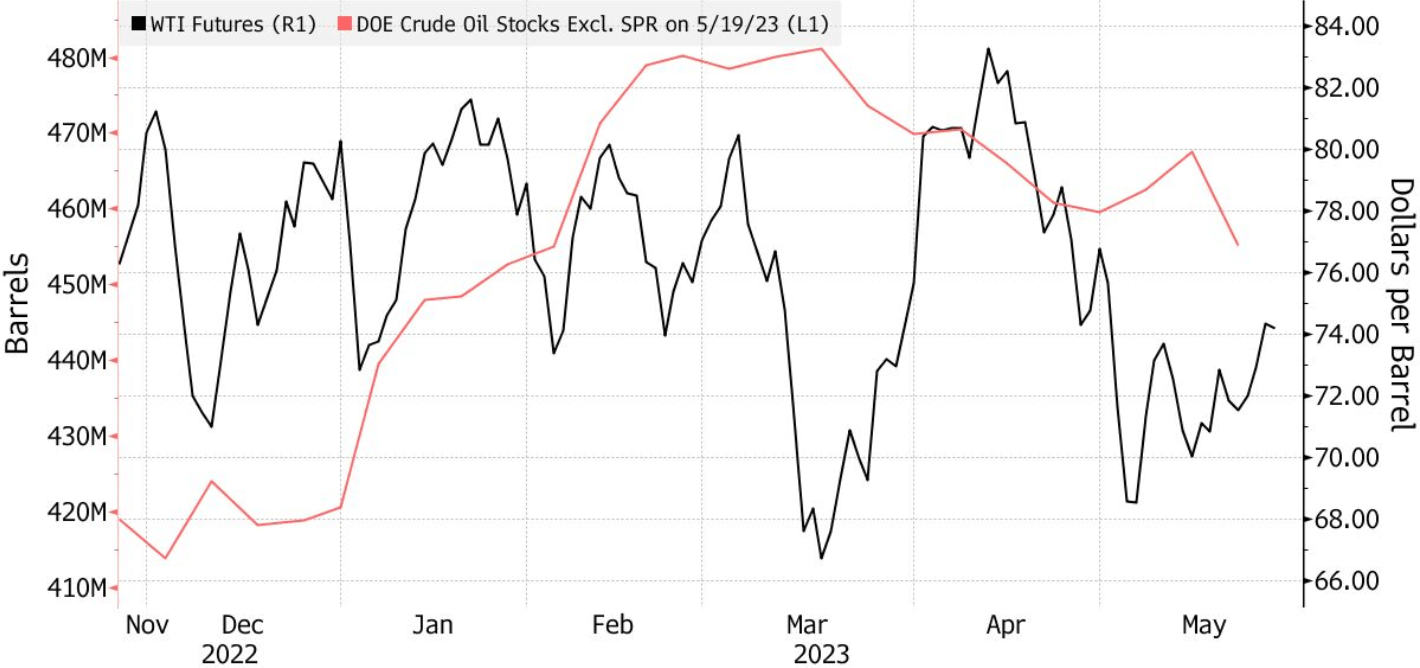

Over the past year, oil prices have dropped by 8%. Oil analyst Sean Lim believes that the prospects of the oil market are negatively affected by macroeconomic factors such as the US debt ceiling issues and a stringent monetary policy. However, considering the accelerated recovery of China’s economy, an increase in oil prices can be expected in the second half of the year.