The Taiwanese dollar has experienced significant economic fluctuations this quarter. The negative impact of investor outflow from the Asian market and complex economic factors has exacerbated the situation, posing even greater potential losses. The currency has fallen by over 2% against the dollar since the beginning of the quarter, marking the largest decline in the region.

One of the key influencing factors on the Taiwanese dollar’s exchange rate is investment behavior. Local investors have shifted towards investing in exchange-traded funds, while foreign investors have been actively selling stocks. This dynamic has caused significant volatility in the currency market.

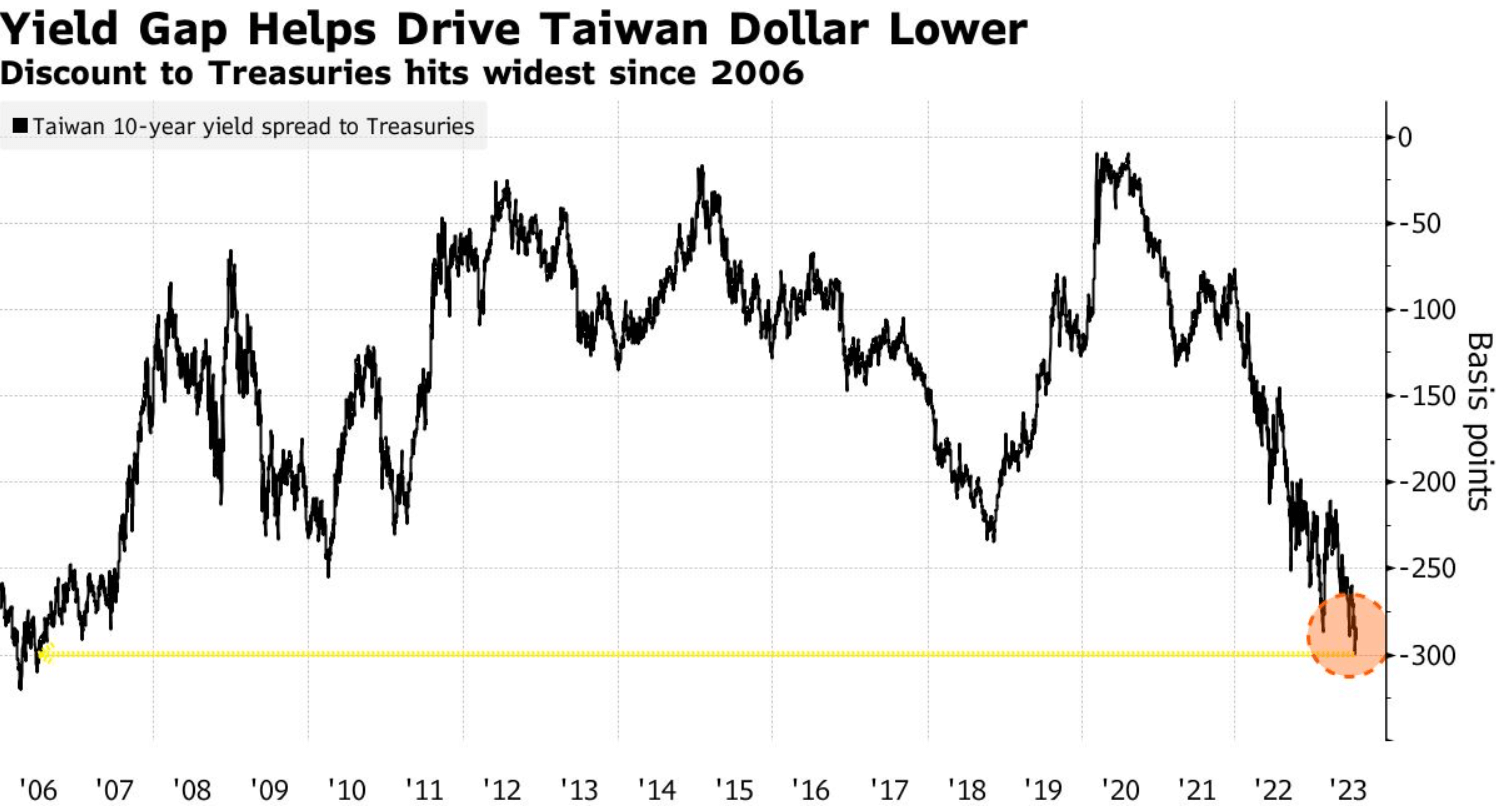

Furthermore, the increase in discount to Taiwanese Treasury bonds and the decrease in yield of 10-year bonds have played a role in weakening the national currency. This is also connected to global financial trends.

Recent economic data also indicates a challenging situation. Taiwan’s exports continue to contract, with a 10.4% decrease recorded in July, marking the eleventh consecutive decline. This has impacted Taiwanese exporters who are compelled to sell dollars less aggressively in order to offset economic losses.

It is reported that investors are also choosing to invest overseas in exchange-traded bonds, creating an ongoing pressure on the local currency. Managers of Exchange-Traded Funds (ETFs), major investors in foreign bonds, are compelled to sell Taiwanese dollars to invest in foreign assets.

Overall, the situation with the Taiwanese dollar is significantly influenced by several factors, and analysts anticipate that the currency may continue to experience fluctuations in the near future, driven by both internal and global economic factors.