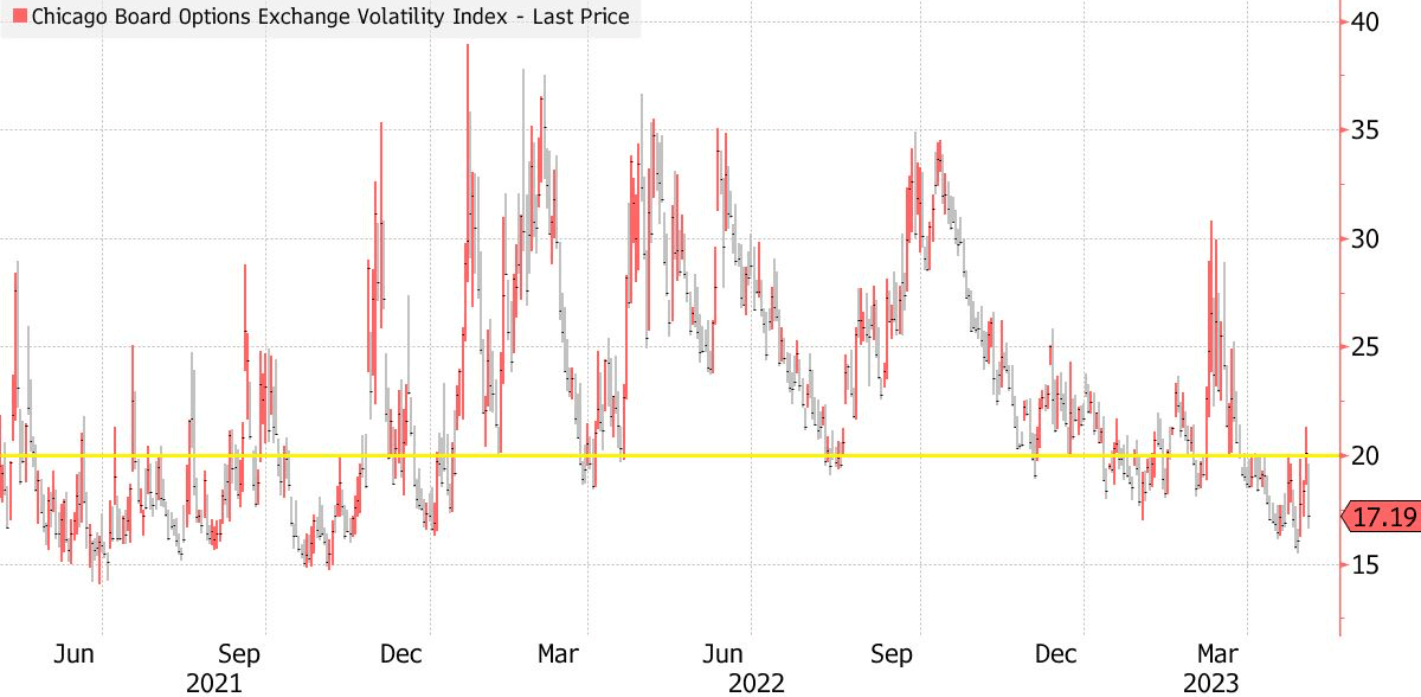

News from the financial markets in the US and Europe continues to attract the attention of investors worldwide. On Friday, the S&P 500 performance broke the longest losing streak since February, lifting the benchmark index by 1.9%. Stock markets are witnessing a growth of Nasdaq 100 by 2.1% and Apple Inc. shares by almost 5% after the company surpassed profit forecasts. However, the volatility index VIX recorded a four-day surge.

The publication of data on wages in the US demonstrated the resilience of the labor market, reducing investor fears of a possible recession. This information also fueled rumors that the Federal Reserve System (Fed) may maintain higher interest rates and possibly increase them again in June. Tai Hui, the chief Asia market strategist at JPMorgan Asset Management, stated that the Fed ought to be quite comfortable with where policy rates are right now unless there is a sharp turnaround in the inflation numbers.

As a result, stock markets are showing signs of recovery, and employment data in the US along with wage growth provide confidence in the stability of the economy. The US Federal Reserve continues to maintain high-interest rates, which may contribute to growth in the stock markets in the near future. However, concerns about inflation remain, and the future of the economy is uncertain.