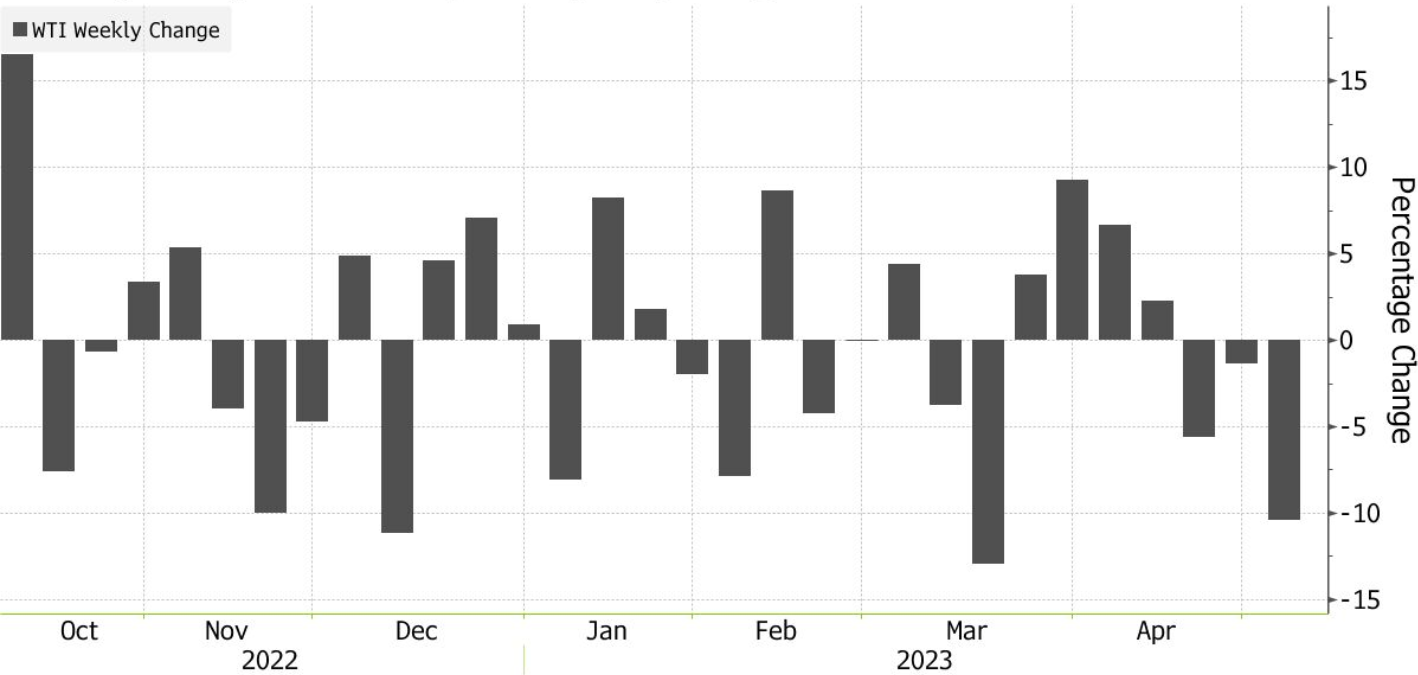

Prices have been falling for three weeks in a row due to investor concerns that a US recession could lead to reduced energy consumption. Saudi Arabia, one of the largest oil exporters, has also lowered prices for its Asian buyers.

Even after the Organization of the Petroleum Exporting Countries and its allies decided to reduce production, the price of black gold has fallen 14% since the beginning of 2023. However, despite the decline in price, the physical oil market appears stable, which could indicate excessive sales of the commodity.

Warren Patterson, the head of commodities strategy for ING Groep NV, stated that the market is in oversold territory. He also mentioned that their balance sheet indicates that the market will be in deficit over the second half of the year, which he believes should drive prices higher, despite the current negative sentiment.