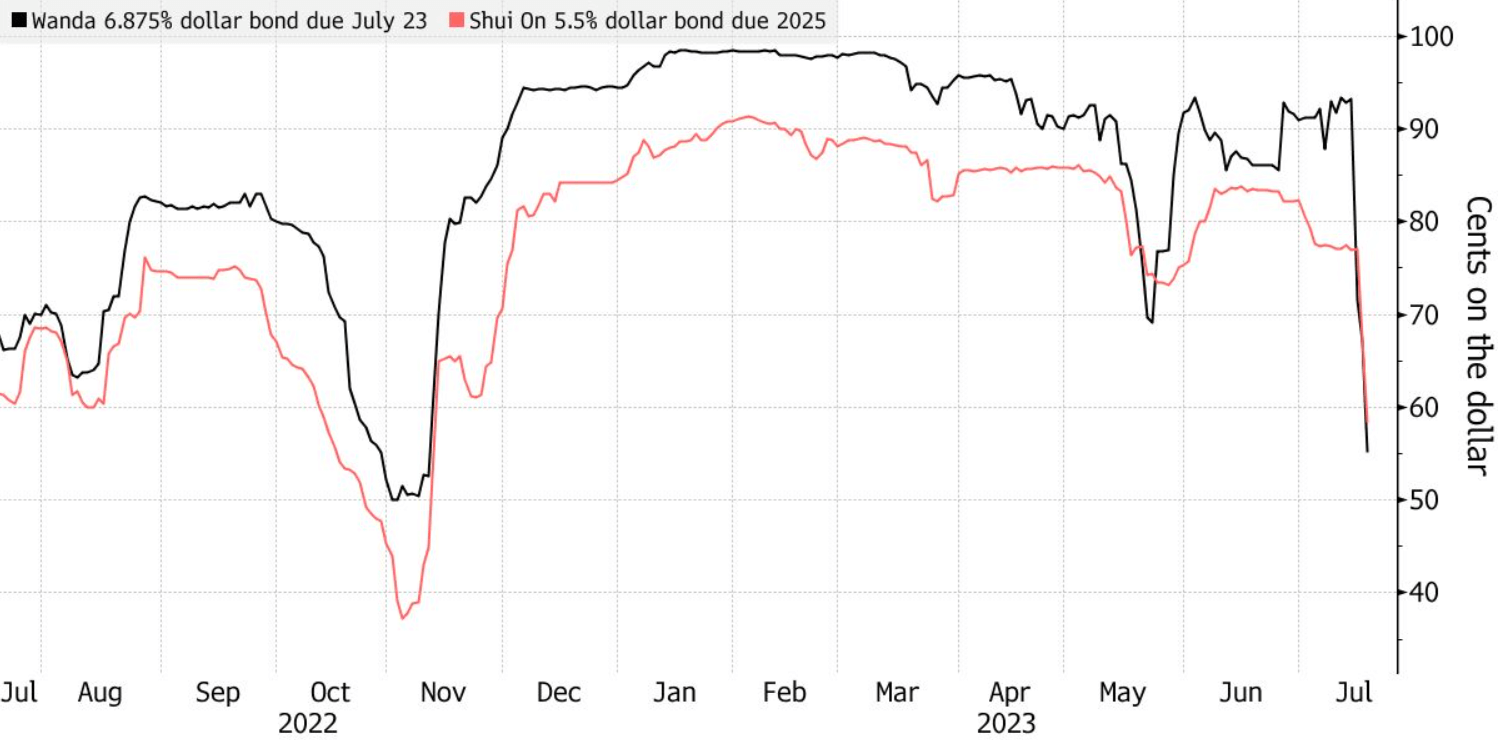

China’s high-yield dollar bonds are experiencing the sharpest three-day sell-off this year, reflecting the deepening liquidity crisis even for companies with access to financing. Greenland Holding Group Co. has announced a default on its 6.75% dollar bonds, supported by Sino-Ocean Group Holding Ltd., and proposed the restructuring of local notes within a year. The bond price decline signifies the deepening problem in China’s real estate sector, where companies face funding shortages and difficulties in debt repayment.

The expansion of financial support for developers falls short in resolving the issue, and weakening property sales further strain company finances. Expectations for political support and innovative sector stimulus are low as authorities seek to curb the use of borrowed funds. The situation is compounded by payment delays and nervousness among bondholders of various real estate companies.