The data released on Thursday has fueled optimism in the financial markets. In the United States, initial claims for unemployment benefits reached the highest level since October 2021, while producer prices rose less than economists had expected. These factors indicate that the tightening of Federal Reserve policy may finally start to have an impact.

Analysts believe that the decline in inflation could signal the approaching end of the Fed’s rate hike cycle. This opens up opportunities for companies to focus on their growth rather than managing debt obligations.

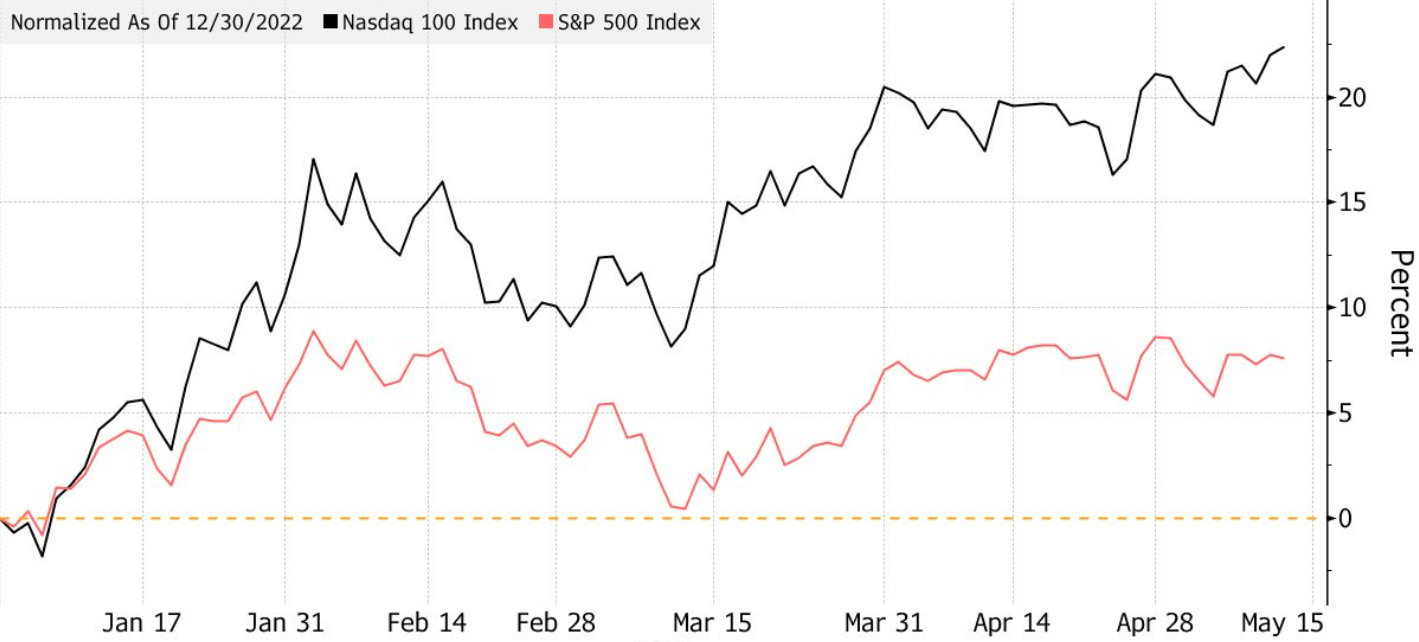

This week, the Nasdaq 100 index rose by 1% in anticipation of Fed policy easing. However, there remains a certain degree of skepticism within the industry.

The situation in the financial markets remains dynamic, and investors are awaiting further changes in Fed policy and other economic indicators.