The market for yen-denominated bonds of global companies has revived amid increased interest rates volatility, offering attractive opportunities for fund managers. Investors are increasingly focusing on debt securities issued in yen by foreign issuers, leading to significant growth in this market.

Demand for yen-denominated bonds has surged, reaching record levels. Major companies such as Bank of Toronto-Dominion, Korea Investment & Securities Co., and BPCE SA have presented significant institutional offerings, contributing to the boom in the yen bond market.

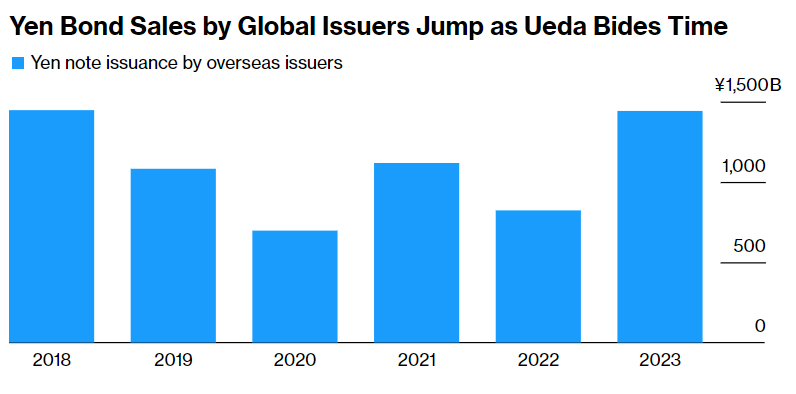

In recent months, the total value of transactions in the market has reached 1.44 trillion yen (approximately 10.2 billion dollars), setting a new record in the last five years. Foreign companies are also showing interest in issuing their bonds in yen, with Korean Air Lines Co. planning to issue bonds in yen this week, and the Korean government intending to sell its first yen-denominated bond in Japan by the end of this year.

One of the attractive aspects of this market is the wider spreads compared to Japanese issuers, which compensate for potential risks for foreign borrowers. Higher bond yields also appeal to investors amid uncertainty in the interest rate market and possible adjustments in the Bank of Japan’s policies.

Interest in yen-denominated bond market is supported by endorsements from influential investors, including Warren Buffett, who demonstrated optimism by meeting with corporate leaders in Japan and marketing debt securities in yen through Berkshire Hathaway Inc. Buffett’s company has become the largest foreign issuer of yen-denominated bonds since its debut deal in 2019.

Despite the volatility and rising yields of Japanese government bonds, the yen bond market continues to attract investors with its prospects and high returns. Experts believe that this market offers significant opportunities for diversification and stable investments, making it an attractive choice for many participants in the financial market.