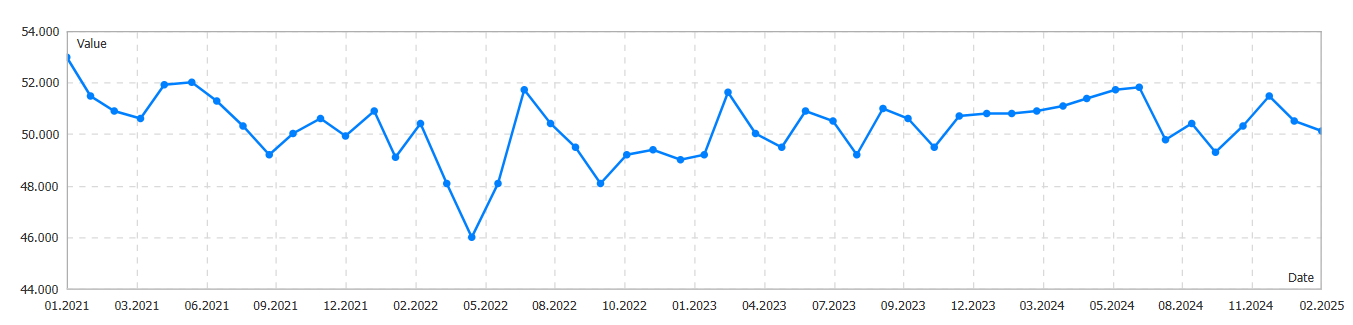

China’s manufacturing PMI, released on Monday, came in lower than December’s reading and below expectations. The index registered at 50.1, missing Reuters’ poll forecast of 50.5. While a PMI above 50 indicates that the industrial sector remains in expansion, the figure is alarmingly close to the contractionary threshold, raising concerns among traders and investors.

Additionally, an independent private survey reported an even weaker outlook. The leading indicator plunged into contraction territory, falling to 49.1 after three consecutive months of expansion. This decline increases the likelihood that the People’s Bank of China will expand its stimulus program this year.

New export orders fell for the second straight month as overseas demand for Chinese goods declined. Meanwhile, the employment sub-index dropped to its lowest level in nearly five years, reflecting deteriorating business sentiment. In 2025, domestic orders will need to play a larger role in driving manufacturing growth, especially as tariffs take effect.

The U.S. President has signed an executive order imposing a 10% tariff on all imports from China. Additionally, Donald Trump has directed his administration to investigate China’s compliance with a trade deal established during his first presidency. According to officials from the Caixin Insight Group, uncertainty surrounding international policies could further weaken the export environment.

These tariffs come when China’s economy is already struggling with a slowdown. Although Beijing has achieved its 5.0% growth target, it struggles with weak domestic demand and a downturn in the real estate sector. As a result, exports remain a crucial driver of economic growth heading into 2025.