Standard Chartered bank predicts that the price of Bitcoin will reach $120,000 by the end of 2024. This growth will be driven by a reduction in token sales by wealthier miners. The increased profitability of miners allows them to sell fewer Bitcoins, which in turn reduces the overall supply in the market and drives up the price of the cryptocurrency.

This forecast aligns with other ambitious predictions, including the statement by Cathy Wood from Ark Investment Management that Bitcoin could reach $1 million by 2030. However, the previous Standard Chartered forecast of $100,000 by the end of next year has been underestimated.

One of the factors supporting the stability of Bitcoin is the periodic reduction in its supply. The halving of Bitcoin supply occurs every four years and helps maintain the price and overall supply of the cryptocurrency. This process contributes to keeping Bitcoin below the maximum limit of 21 million tokens.

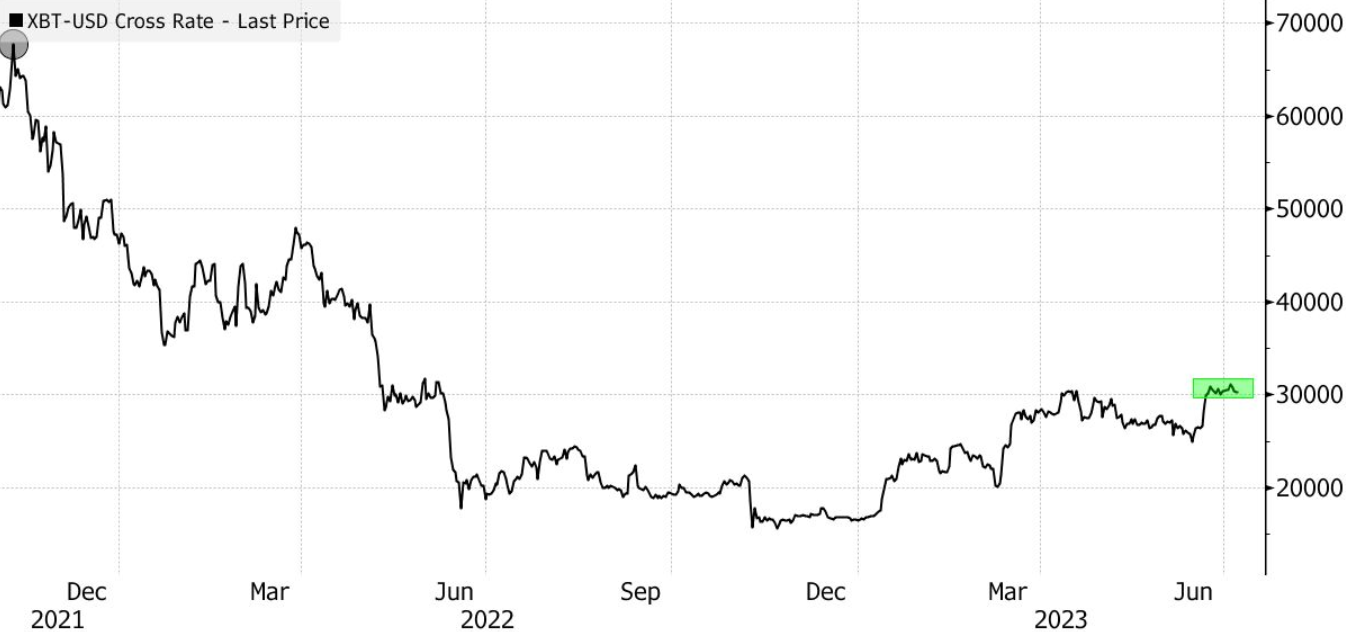

Currently, Bitcoin is trading around $30,309, significantly below its record high of nearly $69,000 reached in November 2021. However, interest in cryptocurrency continues to grow, especially in the United States, where applications for Bitcoin exchange-traded funds, including the one from BlackRock Inc., are gaining increasing support and attention.