Australian banks are forced to warn about a decline in their performance next year. While investors worry about a possible recession and a decrease in rates by the Reserve Bank of Australia, banks expect a slowdown in credit growth. At the same time, last week’s results showed a profit growth, but bank leaders are cautious about future earnings.

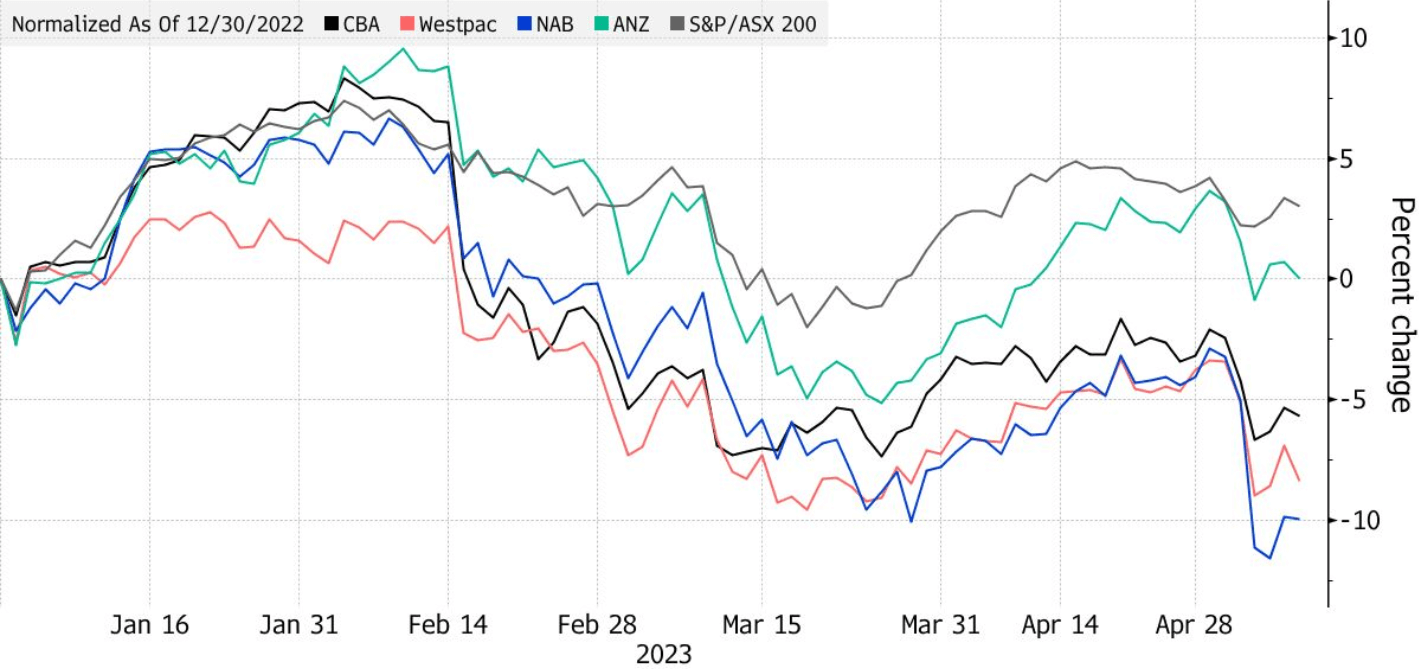

The four largest banks in Australia are struggling this year. Their shares fell along with global banks against the backdrop of the ongoing banking crisis in the United States and numerous creditor collapses. National Australia Bank Ltd. lost nearly 10%. ANZ Group Holdings Ltd., Westpac Banking Corp., and Commonwealth Bank of Australia are also suffering losses.

Chamath De Silva, a senior fund manager for BetaShares, says that investors see peak profits and net interest margins in hindsight, prompting local investors to consider transitioning from banks to more secure sectors such as healthcare or basic food products. Thus, Australian banks are forced to seek new opportunities to increase revenue to remain competitive in the market.