American indices and global stocks continue to trade in narrow ranges. Investors take into account the possible end of the Federal Reserve’s interest rate hikes and risks associated with slowing economic growth. Traders are worried about the confrontation between President Joe Biden and Republicans in Congress. The parties have not yet been able to reach an agreement that would prevent the first default in US history.

Currency strategist at Bank of New Zealand Ltd., Jason Wong, believes that the impact on markets will be minimal until the approach of the “X-date” – the moment when the US reaches the debt ceiling. He emphasized that current news about negotiations is more noise and generally does not have a significant impact on the market.

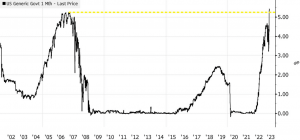

At the same time, the increase in Treasury bill yields leads to higher rates for short-term securities.

Seasoned Wall Street traders warn of potential “unthinkable” long-term damage due to a US default. In connection with the stalemate in negotiations, the US Treasury has also reduced the size of four- and eight-week auctions.