Price action is a trading system allowing traders to follow the price and make trading decisions based on what is happening on charts. This is one of the most popular strategies, as traders need no technical indicators to make assumptions about future price movements. While the price action concept may seem clear and straightforward, some pitfalls may arise. By reading this article, you will delve into the key secrets that will allow you to improve the effectiveness of your strategy.

1: Each Major Trend Comprises Many Smaller Trends

When looking for a price movement direction in a particular timeframe, traders should remember that major and minor trends may change the trading bias. For instance, if the price moves downwards below the descending trendline on the hourly chart, a trader can look at higher timeframes to see whether the trend is confirmed or if this is just a correction.

Why is this knowledge essential? Understanding major trends will allow market participants to avoid placing trades incorrectly. For instance, when trading on the hourly chart, a trader can look at the daily chart and watch the significant trend before placing a trade. One can find entry points if they correspond to the hourly chart’s current price movement.

2: Identify Consolidations

The next crucial price action secret is recognizing consolidations. A trader must identify whether the market trends upwards, downwards, or sideways. This insight helps you apply the right trading strategies.

For example, during an uptrend, a trader can go long at the next low swing, while in a downtrend, they can go short at the next high swing.

In a sideways market, where there is no clear direction, different strategies are needed. Here, traders can buy when the price bounces off support and sell when it fails to break resistance, capitalizing on range-bound movements.

3: Consider Support and Resistance as Supply and Demand

Traders often consider support and resistance level points connected by a line. However, their genuine concept goes far beyond such levels. Support is an area where demand overweighs supply, reflected in the price swing. The next time the price returns to this area (under the same fundamental conditions), buyers retake market control.

Resistance, in turn, is an area where sellers gain enough power to reverse the price and push it lower. If this happens, supply overweighs demand as more sellers go short while fewer buyers are ready to hold their long positions.

What is essential here is to understand that these swing points are sometimes at different levels. They are located in areas instead, which means that it is more important to understand the zone where the price may reverse than trying to draw a horizontal line precisely. Understanding this will allow you to focus on finding areas where the price movement direction may change instead of trying to catch the exact swing.

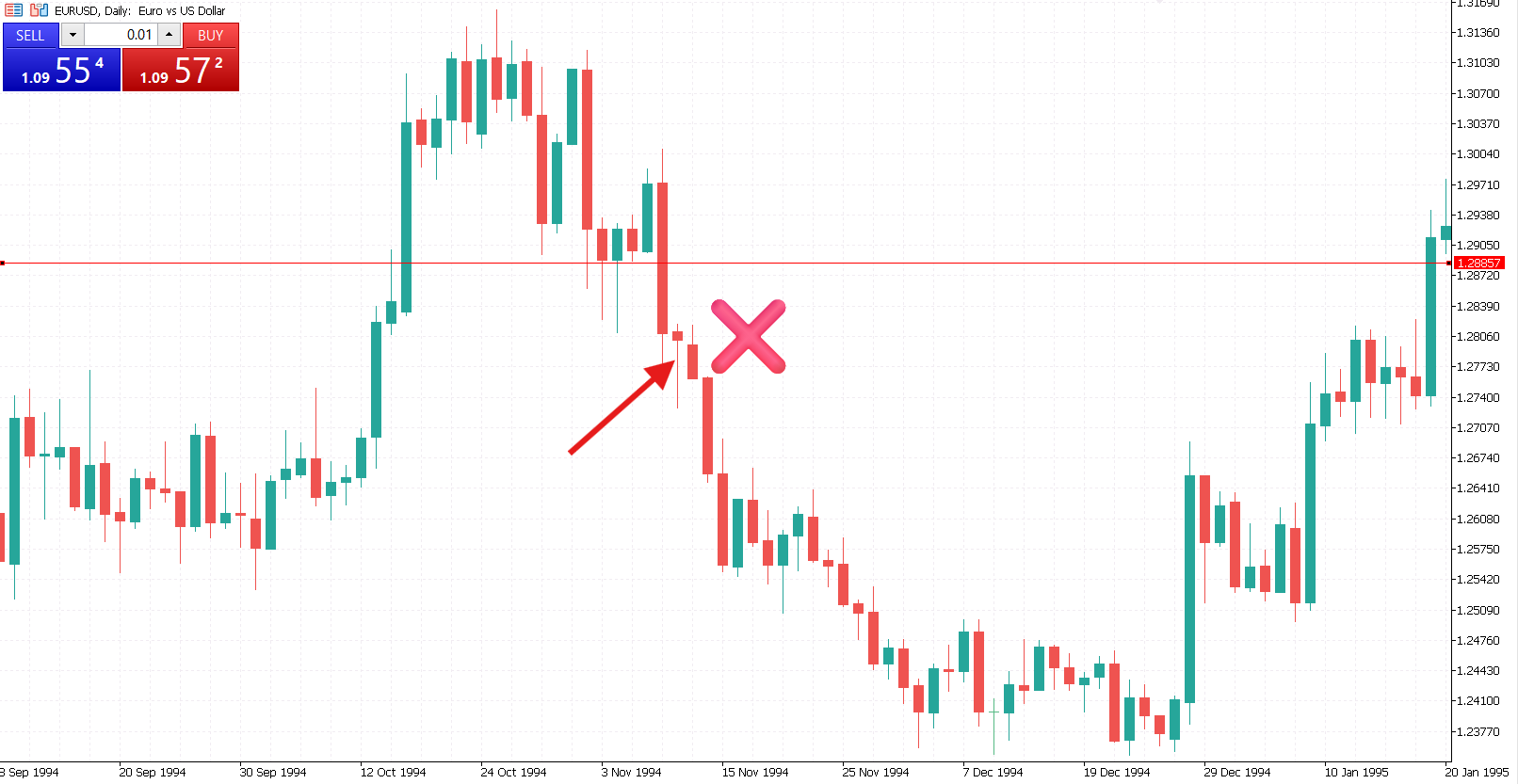

4: Focus on the Position of Candlestick Patterns

When trading Japanese candlestick price action patterns, traders should ensure these setups appear at critical support and resistance levels. In the example above, the hammer candlestick is formed below the resistance level and far from the closest support line. This means market participants should avoid such signals and look for other patterns that meet the support/resistance conditions.

The following example contains a hammer candlestick located at the support level. This time, the pattern meets the support/resistance condition, and one can use it to find entry points.

5: Watch Trend Trajectory and Duration

The trend’s trajectory provides traders with helpful insight into further price fluctuations. Trends moving steadily in one direction are considered strong, especially if no corrections exist. However, once bulls are exhausted, such movements will likely be interrupted soon by a correction.

Gradual trends are more favorable for swing strategy users. They have several corrections during which traders can add to their positions.

6: Measure price Movements to Set Targets

Measuring movements to calculate eventual profits is a rather popular approach among professionals. For instance, when trading with a flag pattern, traders often measure the distance of the flagpole to see how much they can gain after the pattern begins to work.

The example above demonstrates how a trader can use this information. First, they should measure the distance between the first and last points of the flagpole. Later, when the price breaks the lower line of the flag, a trader can sell and set appropriate targets.

7: Learn Price Action Patterns and Practice Them

Knowing price action patterns is crucial. However, finding them on charts is even more important for traders. Not all patterns traders will meet on charts look like those classic ones.

The example above demonstrates the head and shoulders pattern, which looks different from a classic one. However, traders can use it to capitalize on the downside price movement once the quotes break below the neckline (the support level, pinpointed with a red horizontal line).

8: Check Economic Calendars

Trading price action requires no knowledge or previous experience in fundamental analysis. However, even traders who use technical analysis should check economic calendars from time to time.

While price action is a self-sufficient trading system, key macroeconomic data releases can bring significant volatility to financial markets, which may result in unpredictable price movements. Therefore, to avoid them, traders can check the essential data releases in advance and avoid trading at these moments. Moreover, they can even place trades but align them with forecasts available in such calendars.

Mastering the secrets of price action trading lies in understanding the market’s behavior through its movements rather than relying heavily on indicators. Traders can gain valuable insights into market sentiment by studying price patterns, candlestick setups, and key support and resistance levels.

The simplicity of price action allows for a clearer analysis of trends and reversals, offering a strategic edge. However, success in price action trading requires practice, discipline, and an ability to interpret these patterns within the broader context of market structure. The true secret is consistent application and adaptation to different market conditions.