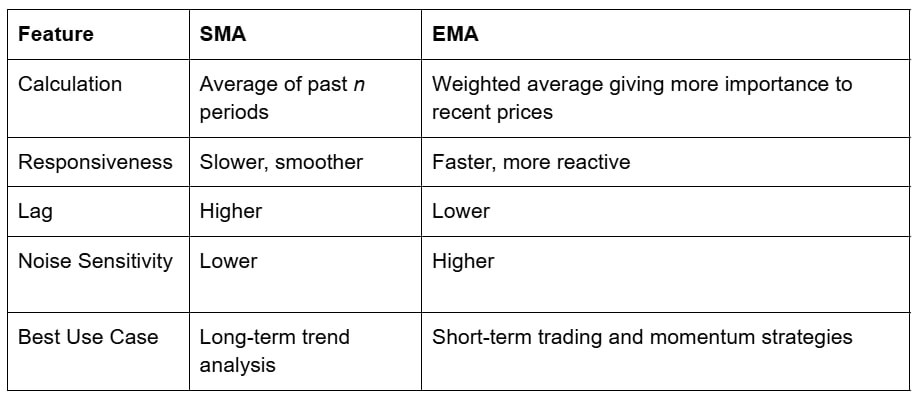

The Simple Moving Average (SMA) and the Exponential Moving Average (EMA) are among the most commonly used types of moving averages so far. While both serve the same purpose, they differ in their calculation methods, responsiveness, and practical applications. Understanding the nuances between SMA and EMA can significantly improve trading strategies, risk management, and overall market analysis.

What is a Simple Moving Average (SMA)?

A Simple Moving Average is the most straightforward type of moving average. It is calculated by adding the closing prices of a security over a specific number of periods and then dividing by that number of periods. For example, a 10-day SMA adds the closing prices for the last 10 days and divides the sum by 10.

The SMA provides a smooth line that reflects the average price over time. Its primary strength is its simplicity, it’s easy to understand and implement. Traders often use SMA to identify overall trends and support/resistance levels. Common periods for SMA include 20, 50, and 200 days, depending on whether the trader is looking at short-term, medium-term, or long-term trends.

Advantages of SMA

- Simplicity. Very easy to calculate and interpret.

- Trend identification. Smooths out short-term fluctuations to highlight long-term trends.

- Widely used. Standard in most trading platforms and research studies.

Limitations of SMA

- Lagging indicator. Because it treats all data equally, SMA reacts slowly to recent price changes.

- Less sensitive. Not ideal for fast-moving markets or for capturing short-term price movements.

What is an Exponential Moving Average (EMA)?

The Exponential Moving Average is designed to give more weight to recent price data, making it more responsive to current market conditions. Unlike the SMA, the EMA reacts faster to price changes, which can help traders spot trends earlier or identify potential reversals sooner.

By placing greater emphasis on recent prices, the EMA reduces the lag that is inherent in the SMA. This responsiveness is especially valuable in volatile markets, where timely entries and exits are critical.

Advantages of EMA

- Responsive. Reacts quickly to price changes, making it suitable for short-term trading.

- Trend signals. Helps detect potential trend reversals sooner.

- Popular in technical indicators. EMA forms the basis of many trading strategies, such as MACD (Moving Average Convergence Divergence).

Limitations of EMA:

- More sensitive to noise. Can produce more false signals in choppy or sideways markets.

- Slightly more complex. Calculation and interpretation are more complex than SMA.

SMA vs EMA: Key Differences

The choice between SMA and EMA largely depends on trading style, market conditions, and time horizon. For example, long-term investors may prefer SMA to reduce sensitivity to short-term volatility, whereas day traders often rely on EMA to capitalize on quick market movements.

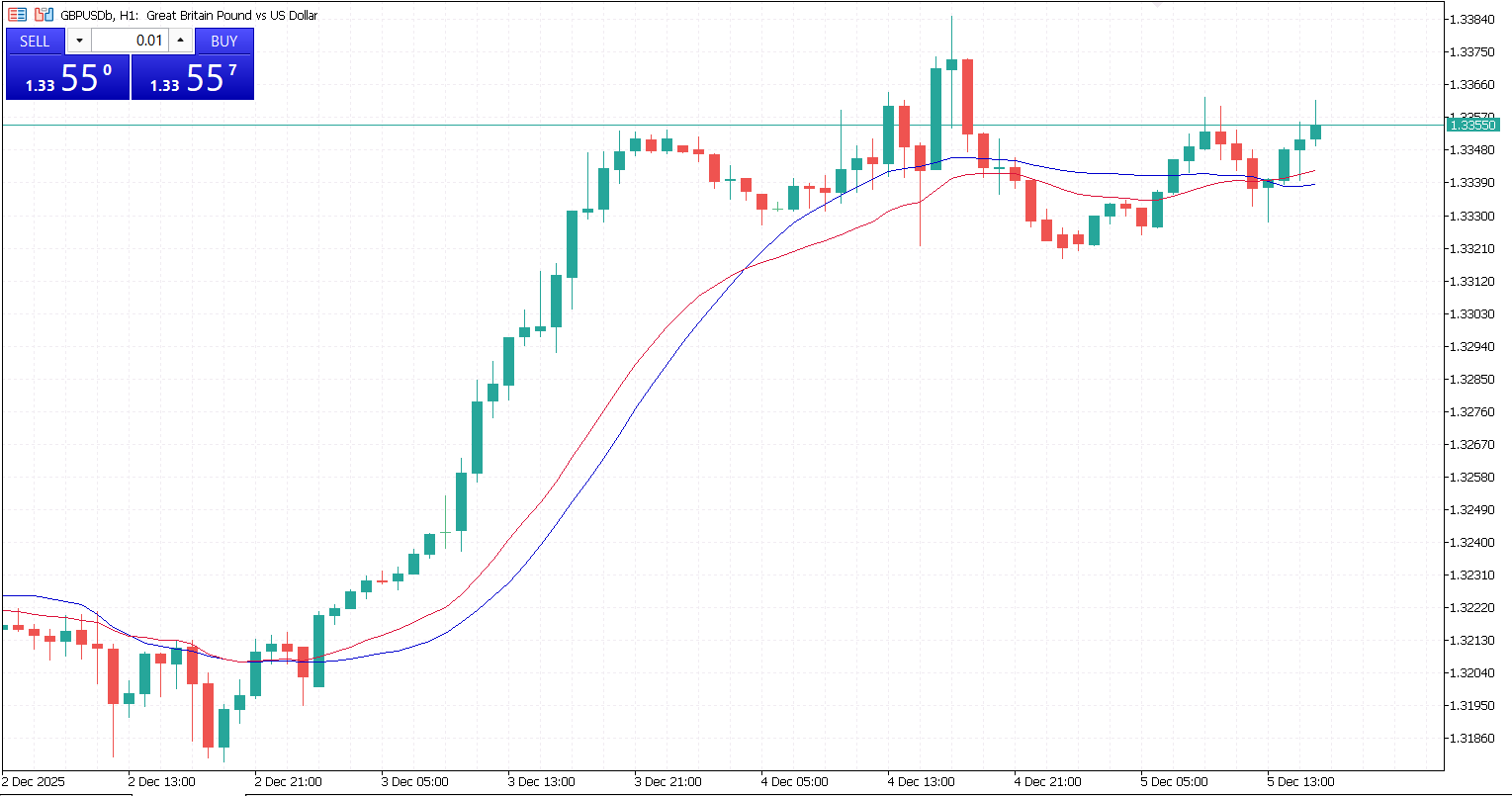

Practical Applications in Trading

SMA and EMA can both help confirm market trends. When the price moves above the 50-day SMA or EMA, it usually suggests a bullish trend, while dropping below often signals a bearish trend. These signals help traders understand whether the market is gaining or losing momentum.

Moving averages can also act as dynamic support or resistance levels. The SMA tends to be more stable and reliable over longer periods, making it a useful guide in steadily trending markets. The EMA, on the other hand, reacts more quickly to price changes, which can create support or resistance levels that shift more rapidly.

Traders frequently use crossovers of short-term and long-term moving averages to generate buy or sell signals. A well-known example is the “golden cross,” where a short-term average crosses above a long-term one, suggesting the start of a potential upward trend. The opposite, known as a “death cross,” can signal potential downward momentum.

Because the EMA responds quickly to recent price movements, it is often preferred in volatile markets where faster reactions are important. The SMA, being smoother and slower to adjust, is typically favored in more stable markets where traders want to avoid overreacting to short-term fluctuations.

Both SMA and EMA are indispensable tools in technical analysis, each with unique strengths and limitations. The SMA provides a simple, stable perspective on market trends, while the EMA offers a faster, more sensitive view of recent price action. Recognizing when to use each type of moving average, or combining them strategically, can enhance decision-making and improve overall trading performance. Whether you are a long-term investor seeking trend stability or a short-term trader hunting for momentum, understanding the distinction between SMA and EMA is a crucial step toward more effective, informed trading.