Silver has been treasured for centuries, not only as a form of currency and jewelry but also as a key industrial metal. Unlike gold, which is often viewed primarily as a hedge against inflation or a safe-haven asset, silver plays a unique dual role: it is both a precious metal and an industrial commodity. This dual nature makes silver trading particularly appealing for investors and traders.

Understanding the fundamentals of silver trading is crucial for anyone looking to enter this market, whether as a casual investor or a professional trader. In this article, we will explore the essential concepts, trading strategies, and risks involved in silver trading, providing a comprehensive foundation for newcomers.

Understanding Silver as a Commodity

Silver is considered a precious metal due to its rarity, luster, and historical use as currency. However, unlike other precious metals, silver also has extensive industrial applications, ranging from electronics and solar panels to medical equipment and photography, which significantly influence its demand and contribute to price volatility.

Factors Affecting Silver Prices

- Supply and demand dynamics. Silver production primarily comes from mining, with countries such as Mexico, Peru, and China among the major producers. Demand is influenced by industrial use, investment demand (bullion and ETFs), and jewelry consumption. Fluctuations in either supply or demand can cause significant price changes.

- Economic conditions. Silver is often seen as a hedge against inflation and currency devaluation. When confidence in fiat currencies declines, or interest rates remain low, silver prices may rise as traders seek tangible assets.

- Geopolitical factors. Political instability, trade wars, and changes in mining regulations can disrupt silver supply chains, causing price volatility.

- Market sentiment and speculation. Like other commodities, silver prices are influenced by market sentiment. News, investor sentiment, and speculative trading can amplify short-term price movements.

Fundamental vs. Technical Analysis

Successful silver trading often relies on a combination of fundamental and technical analysis.

Fundamental Analysis

This involves assessing silver’s intrinsic value by examining supply and demand metrics, macroeconomic indicators, geopolitical events, and industrial trends. For example, rising demand for solar panels can drive up silver prices due to increased industrial consumption.

Technical Analysis

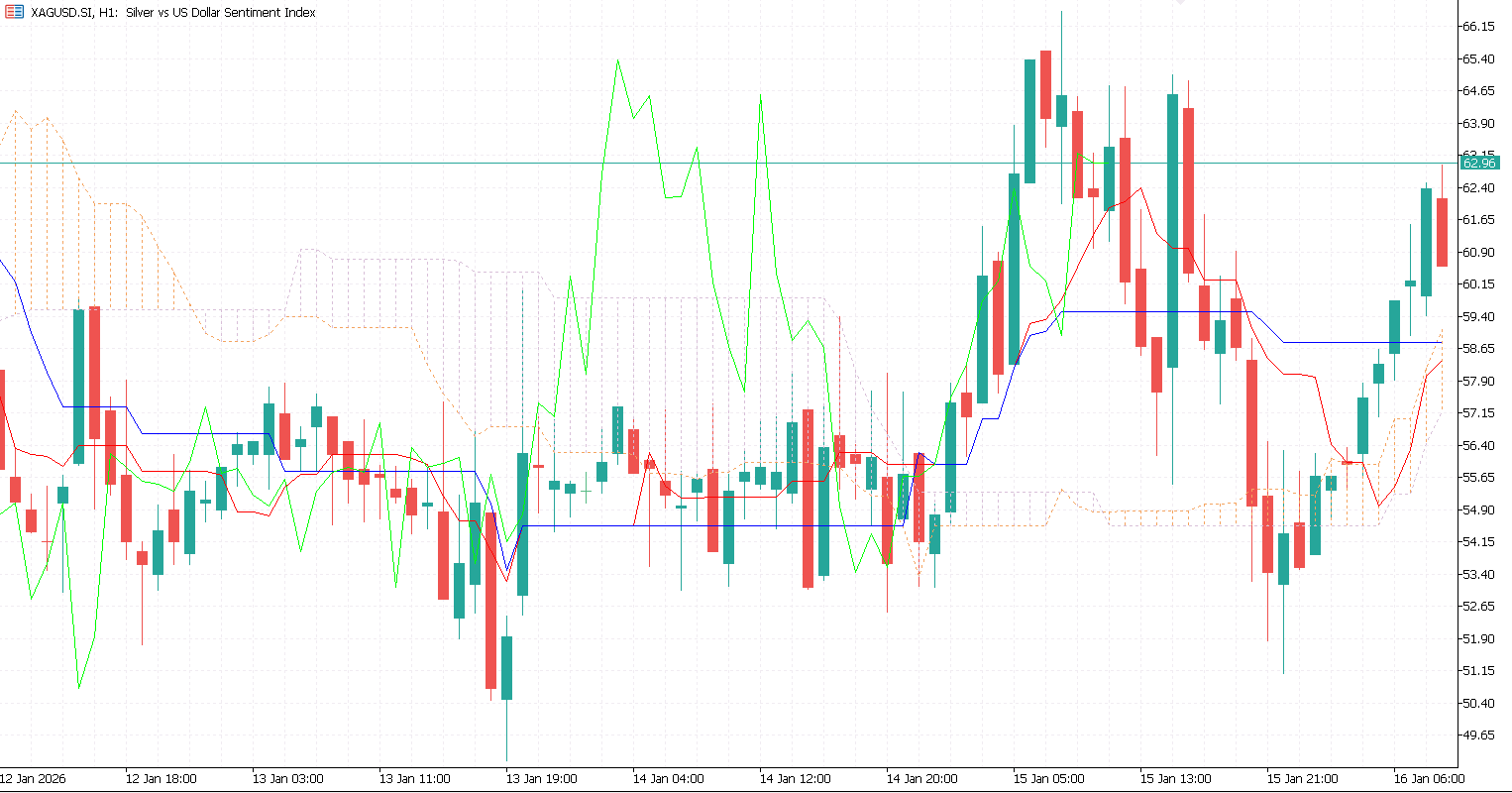

Technical analysis involves studying price charts, patterns, and indicators to forecast future price movements. Common tools include moving averages, Ichimoku Cloud, Relative Strength Index (RSI), Fibonacci retracements, and candlestick patterns. While technical analysis does not consider the intrinsic value of silver, it helps traders identify entry and exit points, trends, and potential reversals.

Benefits and Risks of Trading Silver with CFDs

Trading silver using Contracts for Difference (CFDs) provides traders with flexible market access, but it also involves substantial risk.

Benefits

Silver CFDs allow traders to speculate on price movements without owning the physical metal, reducing storage and insurance costs. CFDs enable leverage, allowing traders to control larger positions with a relatively small initial investment, potentially enhancing returns.

Silver is also a highly liquid and actively traded commodity, offering frequent trading opportunities in both rising and falling markets. Additionally, CFDs make it easy to take long or short positions, allowing traders to potentially profit from both price increases and declines.

Risks

Silver prices are highly volatile and can change rapidly due to macroeconomic data, interest rate decisions, inflation expectations, and geopolitical events. Leverage can amplify profits but also magnify losses, potentially exceeding the initial margin if risks are not managed properly.

During periods of market stress, spreads may widen, and execution may worsen, increasing trading costs and liquidity risk. Silver markets can also be influenced by large institutional traders, leading to sudden short-term price swings.

Developing a Silver Trading Strategy

A robust trading strategy balances potential returns with risk management. Key considerations include:

- Defining objectives. Define clear objectives, whether your focus is short-term trading or long-term investing.

- Diversification. Avoid concentrating all capital in silver; consider other precious metals or assets.

- Strict risk management. Use stop-loss orders, position sizing, and leverage prudently to protect capital.

- Market education. Stay informed about global economic trends, monetary policy, and technological developments that influence silver demand.

Silver trading is a compelling blend of industrial exposure and trading opportunity. Its unique position as both a precious and industrial metal creates dynamic market behavior that can reward disciplined, informed traders. Understanding the factors that influence silver prices is essential for success.

By approaching silver trading with careful research, realistic expectations, and disciplined execution, traders can harness both the historical value and modern utility of this precious metal. In a world of financial uncertainty, silver remains a versatile asset, shimmering not only in jewelry and industry but also in the portfolios of informed and strategic traders.