Markets don’t trend all the time. In fact, most of the time, price moves sideways, consolidating between clear levels of support and resistance. Traders who only wait for breakouts often miss these opportunities, sitting on the sidelines while price continues to move within a defined range.

Range trading allows you to profit in low-volatility environments by buying near support and selling near resistance instead of waiting for a major directional move. By reading this article, you will understand how to identify ranging markets, apply effective range trading strategies, and take advantage of conditions that many traders overlook.

What Is Range Trading?

Range trading is a strategy used when the market moves sideways between clearly defined support and resistance levels. A range forms when price repeatedly bounces between a lower boundary, known as support, and an upper boundary, known as resistance, without establishing a sustained upward or downward trend. These levels act as temporary floors and ceilings where buying and selling pressure balance each other.

Consolidation occurs when neither buyers nor sellers have enough strength to push the market into a new trend. After a strong move, the market often pauses as participants take profits and new positions are built, causing price to fluctuate within a contained zone. This creates the sideways structure that range traders look for.

The key difference between trending and ranging markets lies in momentum and direction. In a trending market, price consistently makes higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend. In a ranging market, price moves horizontally, repeatedly reacting to support and resistance without creating new directional highs or lows. Recognizing this difference is essential because strategies that work in trending conditions often fail in ranging environments, and vice versa.

How to Identify a Range

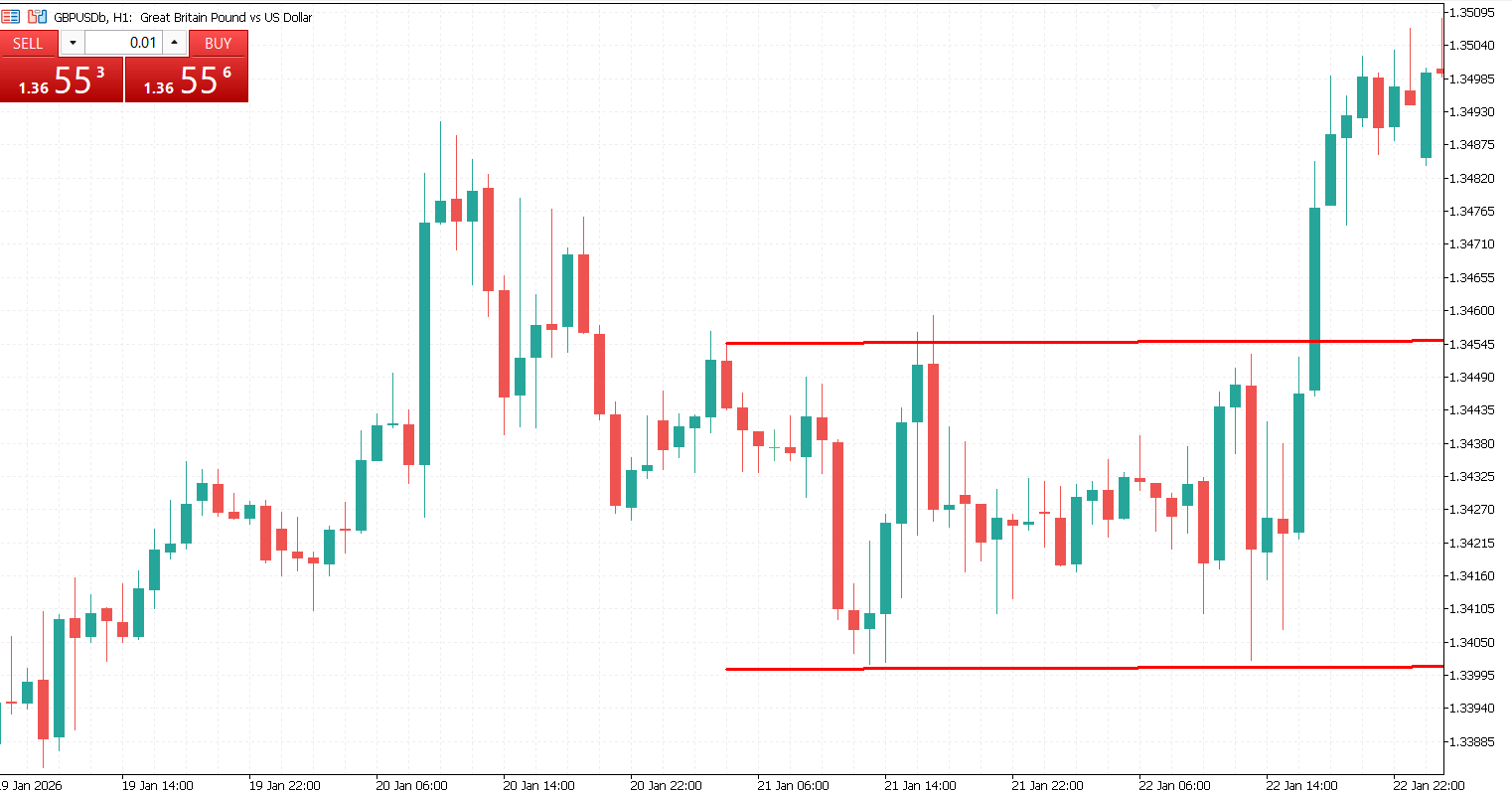

Identifying a range begins with spotting horizontal support and resistance levels that price touches multiple times without breaking. These repeated bounces indicate that the market recognizes these boundaries as floors and ceilings.

Another sign of a range is weak momentum. Indicators like a neutral RSI or flat moving averages show that neither buyers nor sellers are in control, confirming that the market is consolidating rather than trending. Price tends to respect its boundaries during these periods, consistently reversing when it reaches support or resistance.

Volume behavior can also provide clues. In a range, volume often decreases as price moves toward the middle of the range and spikes near the boundaries, reflecting increased activity when traders anticipate reversals. By observing these factors together, traders can confidently distinguish a ranging market from one that is trending, allowing them to plan trades that take advantage of sideways movement.

Entry Strategies

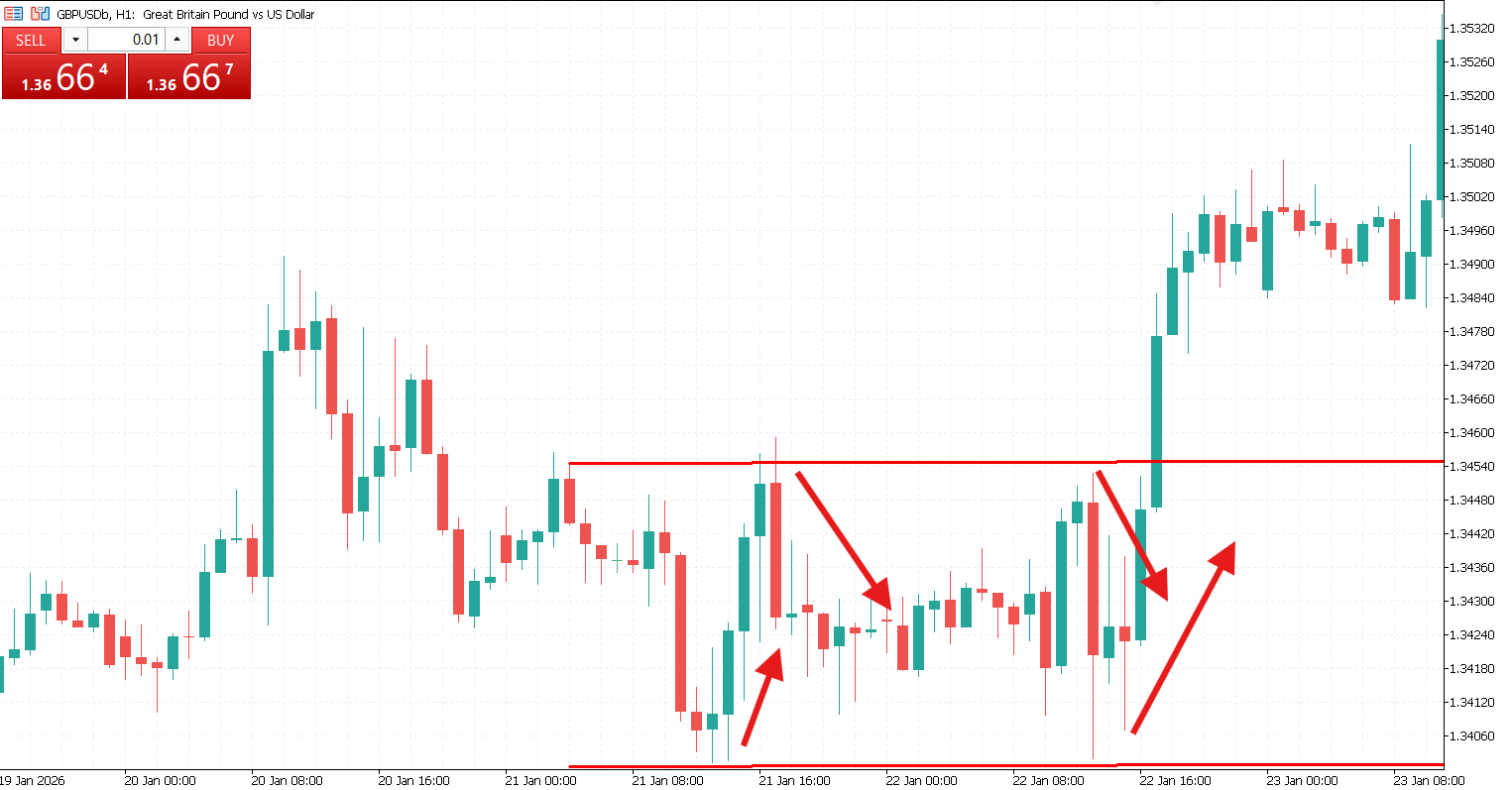

In range trading, entries are most effective when taken near the boundaries of the range. Buying near support allows traders to enter when price is at a potential floor, while selling near resistance takes advantage of the ceiling where selling pressure tends to increase.

Confirmation tools can improve the probability of success. Signals like RSI divergence, reversal candlestick patterns, or signs of false breakouts help confirm that a boundary will hold rather than assuming it will. The key principle is to wait for rejection at the support or resistance levels instead of guessing where price might turn. By letting the market show its intent, traders can enter trades with higher confidence and reduce the risk of getting caught in a breakout or sudden trend.

Risk Management in Range Trading

Effective risk management is essential when trading ranges. One of the first rules is to place tight stop-loss orders just outside the boundaries of the range. This limits potential losses if price breaks out unexpectedly.

Planning risk-to-reward ratios is equally important. Since ranges are typically smaller than trending moves, targeting realistic profits while controlling losses ensures trades remain favorable over time. Avoiding overtrading inside the range is another key principle; forcing trades in low-probability situations can quickly erode gains.

Position sizing should reflect both account size and the volatility of the range. Smaller positions reduce risk when boundaries are narrow, while slightly larger positions can be taken in wider ranges. By combining careful stops, thoughtful risk-to-reward planning, and disciplined position sizing, traders can navigate sideways markets safely and consistently.

When NOT to Trade the Range

Not every market condition is suitable for range trading. High-impact news events, such as economic reports or central bank announcements, can trigger sudden price spikes that easily break range boundaries. Similarly, strong fundamental shifts, like major policy changes or unexpected earnings surprises can create directional moves that invalidate the range.

Traders should also be cautious when volatility starts increasing near potential breakout zones. Rising momentum often signals that a new trend is forming, making range strategies risky. Signs of accumulation or distribution, where large market participants are building or unloading positions, can also indicate that a breakout is imminent. Recognizing these situations and stepping aside protects traders from losses that occur when the market leaves its familiar sideways pattern.

Range trading rewards patience and discipline. Unlike chasing trends or hoping to catch every big move, the goal is consistent, measured gains by trading within well-defined boundaries. Sideways markets, which many traders see as boring or unprofitable, actually offer abundant opportunities for those who are prepared. By understanding how to identify ranges, enter with confirmation, and manage risk carefully, the patient trader can turn periods of low volatility into a reliable source of profit.