Take profit orders are crucial tools for traders, enabling them to secure profits by automatically closing a position when it hits a specified price level. Proper placement of take profit orders involves setting them at strategic levels that align with the trading strategy and current market conditions, ensuring profits are captured while minimizing the risk of market reversals. The article offers valuable insights and practical tips on effectively setting and managing take profit orders to enhance trading performance and protect gains.

What is a Take Profit Order?

A take profit order is an instruction given to a broker to automatically close a trading position once the price reaches a specific predetermined level. This order is designed to secure profits by locking in gains before market conditions change unfavorably.

Unlike a stop loss order, which aims to limit losses by closing a position when the price moves against the trader, a take profit order is used to capture profits when the market moves in the desired direction.

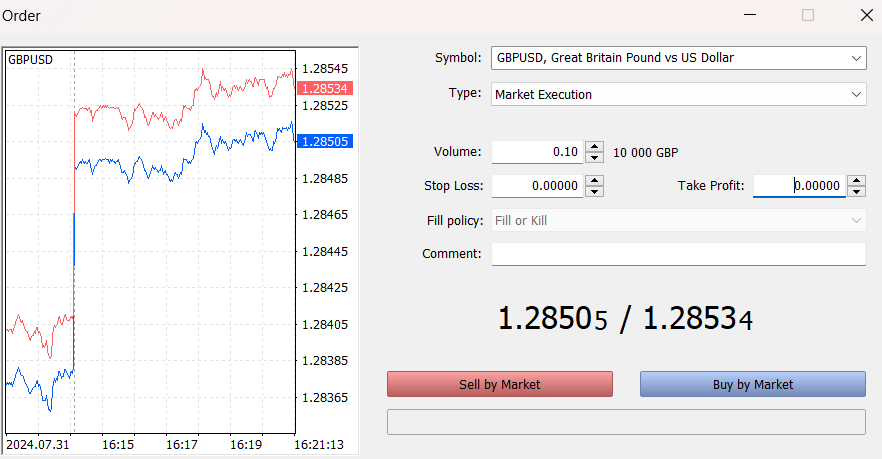

Most major trading platforms, including MetaTrader 4 and 5, offer take profit options, allowing traders to automate their profit-taking strategies and manage their trades more effectively. By setting a take profit order, traders can ensure they don’t miss out on potential gains due to unexpected market fluctuations.

How a Take Profit Order Works

A take profit order is a straightforward yet effective trading tool designed to automatically close a position when the price reaches a specific level, ensuring that profits are secured before market conditions change.

For instance, if a trader anticipates that an asset, currently trading at $20, will rise to $30, they can place a buy order expecting to benefit from the upward movement. By setting a take profit order at $30, the trader instructs their broker to close the position once the price hits this target, thus locking in the gains without constantly monitoring the market.

In addition to a take profit order, traders can implement a stop loss order to manage risk. For example, if the same trader decides to set a stop loss at $15, this order would trigger an automatic sell if the price drops to this level, thus limiting potential losses.

This combination of take profit and stop loss orders helps traders secure their earnings and protect themselves from significant losses, allowing for a more disciplined and strategic approach to trading.

Setting Take Profit Orders: Recommendations

Setting a take profit order effectively is crucial for traders seeking to maximize their returns and manage their trades efficiently. While there is no one-size-fits-all answer for where to place a take profit order, several methods can guide traders in determining the optimal level for this order.

Risk-Reward Ratio

One popular approach involves using the risk-reward ratio, a fundamental principle in trading that helps balance potential gains with the risk undertaken. For instance, if a trader is willing to risk 5% of their capital on a trade, they might set their take profit level 5% above their entry price to match their risk exposure with their profit potential.

Suppose a trader buys an asset priced at $20; setting a take profit order at $21 aligns with their 5% risk-reward ratio. Though this 1-dollar target might seem modest, it represents a 5% return on the trade, effectively managing risk while aiming for a reasonable profit. By adhering to this principle, traders ensure that their profit expectations are proportional to the risks they are prepared to take.

Fibonacci Retracement

Another effective method is to utilize Fibonacci retracement levels, which are based on the notion that asset prices often retrace a predictable portion of their previous movements before continuing in the original direction.

Psychological Levels

In addition to these methods, psychological price levels are another critical factor when setting profit orders. Psychological levels, often rounded numbers like $65, $70 or 1.1000, hold significant importance in trading because they frequently represent major resistance or support points. For instance, if crude oil trades at $85 and rises above $89, the following notable resistance level might be at $90.

These round numbers are significant because many traders set their take profit orders and stop losses at these round numbers, creating self-fulfilling prophecies in which the price often reacts to these key levels. By setting take profit orders near such psychological thresholds, traders align their profit targets with common market behavior patterns, potentially optimizing their exit points based on collective trader psychology.

Setting effective take profit orders is essential for optimizing trading results and managing risk. By leveraging methods such as the risk-reward ratio, Fibonacci retracement levels, and psychological price levels, traders can make informed decisions about where to exit their trades for maximum benefit. Each strategy provides valuable insights and aligns profit targets with market behavior, ultimately enhancing the trader’s ability to capture gains while managing risk. Mastery of these techniques can lead to more strategic and successful trading.