With a daily turnover ranging from two to three trillion dollars, the Forex market is the largest financial market in the world. Around the clock, 5 days a week, investors and traders worldwide engage in currency trading. It’s a demanding endeavor, as there’s always a risk of missing opportunities or losing positions due to volatility spikes. To avoid this, you need to know when the market experiences the highest activity and choose the optimal time for your strategy.

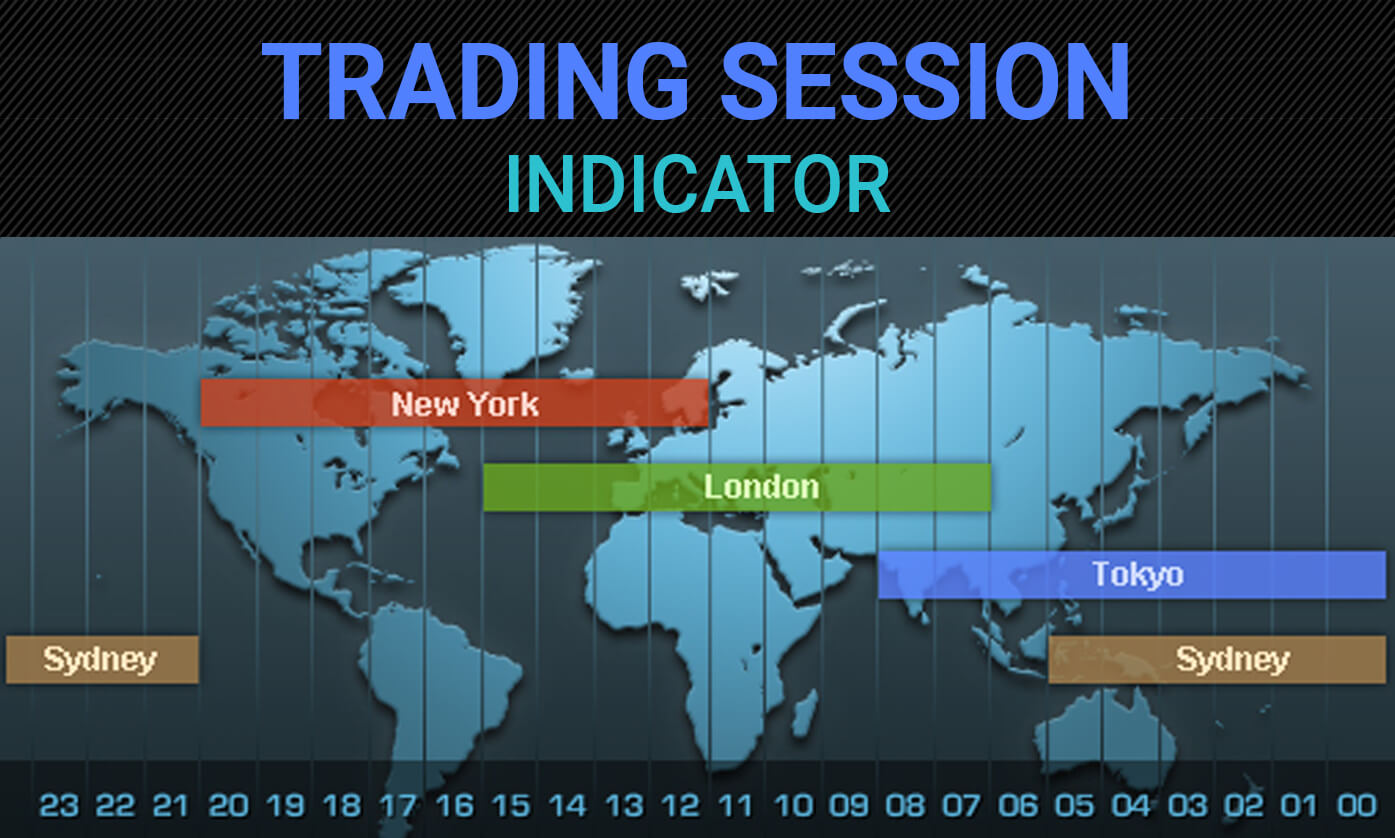

It is customary to distinguish four main periods of activity – the so-called trading sessions in Forex. Let’s delve into each of them and understand how to use the Forex trading sessions schedule to increase your profit.

What is a trading session?

A trading session in the Forex market is a specific period of time during which all market participants in a particular geographical area actively trade currencies. Each session has its name according to regions:

- Asian.

- Pacific.

- European.

- American.

All trading sessions, except the European one, last for 9 hours. The European session lasts for 8 hours.

Types of Trading Sessions

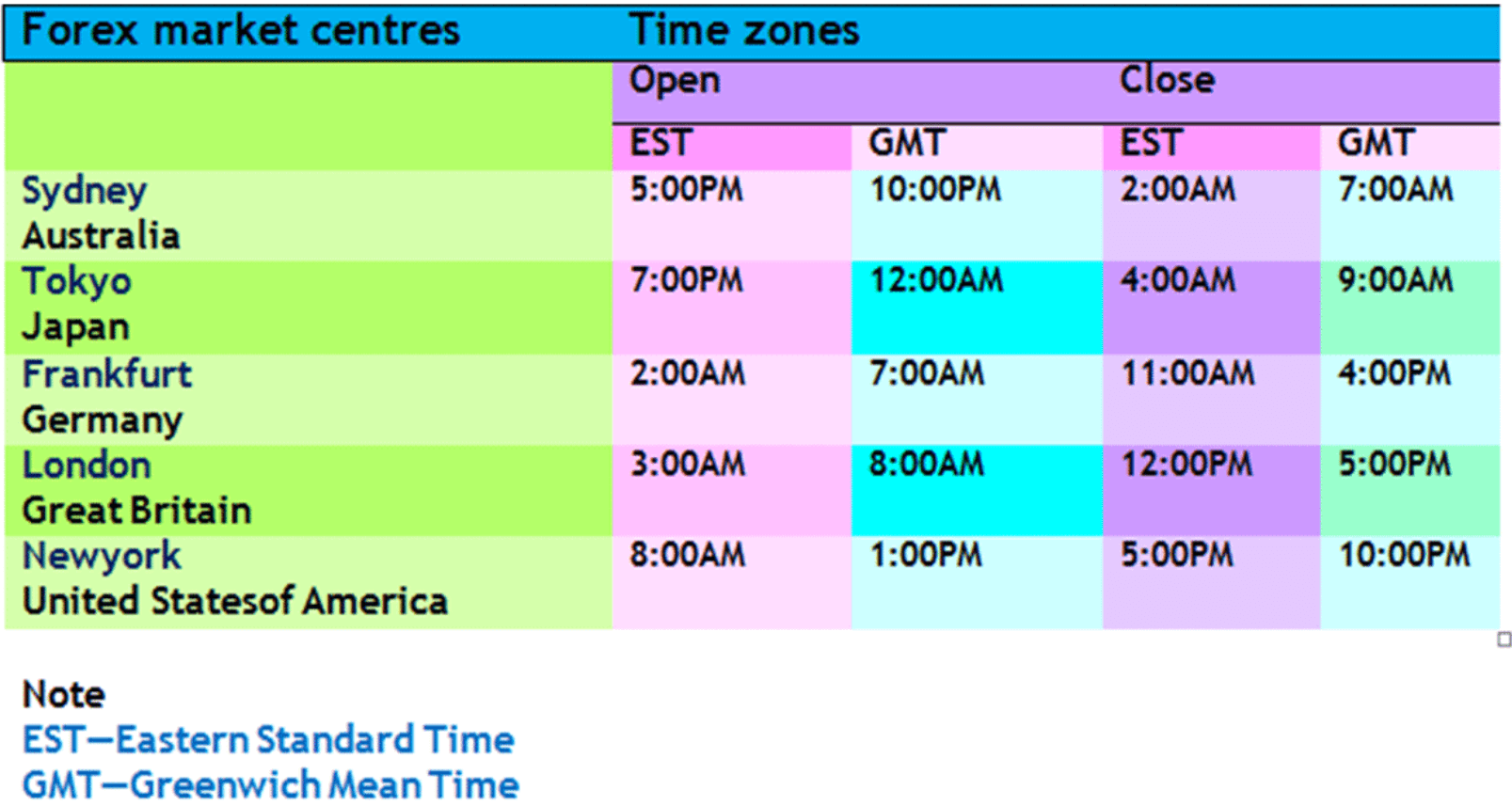

1. Asian (Tokyo) trading session starts at 23:00 and ends at 8:00 GMT. During this period, most major financial centers in Asia are already closed, and market activity is low.

2. Pacific (Sydney) trading session begins at 21:00 and concludes at 6:00 GMT. Here, there is low activity for the same reason – most financial centers in the Pacific region are closed. For these two sessions – Tokyo and Sydney – the Tokyo capital markets, as well as the markets of Australia, China, Singapore, New Zealand, and the eastern part of Russia, are significant.

3. European (London) trading session starts shortly before the closure of the Asian session at 7:00 GMT and ends at 16:00 GMT. This is the most active trading period as all financial centers in Europe are open. The heart of this activity is in London, which is the center of the world’s Forex trading due to its favorable time zone. Consider this: the London session overlaps with the Tokyo and New York sessions, making it the densest and most active. Most of the daily Forex transactions occur during this period. Such activity ensures high liquidity throughout the entire trading session. Spreads naturally become narrower in this situation. The London session hosts the most volatile hours of the currency market. Volatility may decrease during the middle of the session, but once the American trading session opens, volatility increases.

4. American (New York) trading session opens at 12:00 GMT and closes at 21:00 GMT. By the time the American session opens, Asian markets have been closed for about two hours, but Europe is still active. During the American session, financial centers in the United States and Canada, as well as exchanges in South America, are open.

If we represent the hierarchy of financial centers in numbers, we get the following: the United Kingdom with its London is number one among the Forex markets, accounting for about 43% of all trading activity. The United States is second with 19%. Singapore and Hong Kong follow with nearly 8% of trading activity each. Japan closes the top five leaders with its 5%.

When trading Forex, it’s necessary to consider the peculiarities and characteristics of each trading session. Yes, working with time zones may seem confusing at first, but it’s just a matter of getting used to it.

Forex Trading Sessions Overlap

The overlap of London and New York sessions accounts for more than 50% of the total global Forex market trading volume and remains the most significant trading period. Why? It’s simple: more trades mean more price movement. The greater the price movement, the more profit potential. Understanding this, you can decide when it’s best to trade, depending on whether you prefer trading during high volatility or not. For example, the London and New York sessions, especially for non-Asian currency pairs, usually generate the most pip movement in currency pairs and crosses. During the overlap of these sessions, the EUR/USD and GBP/USD pairs are particularly active, while their activity decreases during the Sydney session.

Trading Tips:

- Trade during the first and last hours of each major Forex market session. This will provide you with higher liquidity and narrower spreads for currency pairs.

- Trade during the overlap of trading sessions to get better trading conditions.

- Prioritize the London trading session, as it accounts for nearly half of all trading activity in the Forex market.

Trade with Caution:

- The four major trading sessions have unofficial lunch breaks lasting approximately two hours around noon local time. Reduced liquidity can result in wider spreads, and any established trends during this period are susceptible to reversal.

- Within thirty minutes before or after major news releases. These periods are typically unpredictable and can lead to false breakouts and whipsaws. News trading is popular but tends to be highly risky.

Conclusion:

When trading in the Forex market, you should determine which level of volatility suits your trading style – high or low. If you prefer high volatility, consider trading during session overlaps or economic news releases. Otherwise, avoid these periods.

By understanding the characteristics of each trading session and applying this knowledge in practice, you gain a significant advantage in trading. To keep the Forex trading sessions schedule handy, bookmark this article and watch your profits soar!