Engulfing candlestick patterns are some of the most effective tools traders use to identify potential shifts in market sentiment and predict trend reversals. These two-candle formations provide valuable insight into market psychology, offering traders opportunities to enter trades ahead of a price move. This article will explain the significance of the bullish and bearish engulfing pattern and how you can incorporate it into your forex trading strategy.

What Is an Engulfing Pattern?

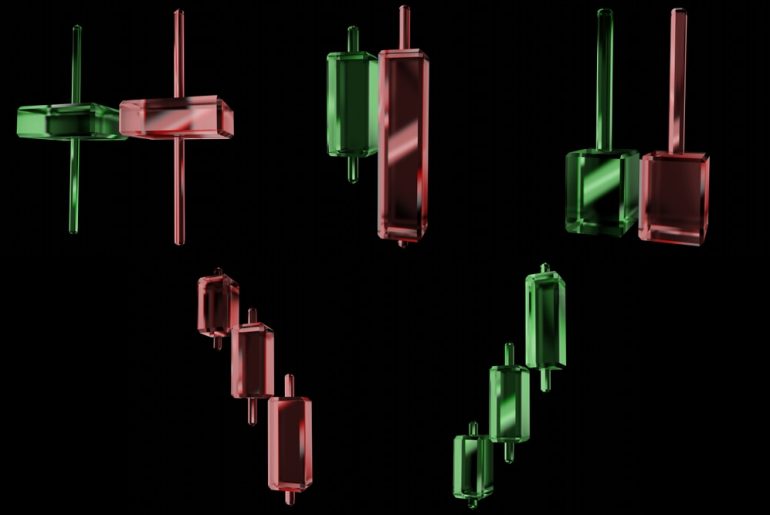

An engulfing candlestick pattern is a two-candle formation that signals a potential reversal in market direction.The first candle is small, while the second candle completely engulfs the body of the first. The key to understanding an engulfing pattern lies in the color of the second candle, as it indicates the direction of the potential trend reversal:

- Bullish Engulfing Pattern. A green (bullish) candle follows a red (bearish) candle during a downtrend. This suggests a possible reversal to the upside.

- Bearish Engulfing Pattern. A red (bearish) candle follows a green (bullish) candle during an uptrend. This suggests a possible reversal to the downside.

What Is the Bullish Engulfing Pattern?

A bullish engulfing pattern signals a potential uptrend reversal. The following sequence can recognize this pattern:

- Downtrend. This pattern typically appears at the end of a downtrend, which is characterized by a series of lower highs and lower lows.

- Small Bearish Candlestick. The first candle is a small red (bearish), signaling that sellers are in control.

- Engulfing Green Candlestick. The second candle is a larger green (bullish) candlestick that fully engulfs the body of the first red candle. This indicates that buying pressure has increased, potentially overpowering the sellers.

- Shifting Market Sentiment. The bullish engulfing pattern suggests a shift in market sentiment, with buyers benefiting from a prolonged downtrend.

How to Trade the Bullish Engulfing Pattern

To effectively trade a bullish engulfing pattern, follow these steps:

- Identify the Downtrend. Look for a clear downtrend characterized by lower highs and lower lows.

- Spot the Engulfing Pattern. After a small bearish red candle, look for a larger green bullish engulfing candle. This indicates a reversal of sentiment from bearish to bullish.

- Confirm the Pattern. Ensure the bullish reversal is supported by higher trading volume, suggesting stronger buying interest.

- Enter the Trade. Once confirmed, you can enter a long position, anticipating a price increase. To manage risk, set a stop-loss order below the low of the first red candle to limit potential losses if the reversal fails to materialize.

What Is the Bearish Engulfing Pattern?

A bearish engulfing pattern signals a potential downtrend reversal. The following sequence recognizes this pattern:

- Uptrend. This pattern typically forms at the end of an uptrend, characterized by a series of higher highs and higher lows.

- Small Bullish Candlestick. The first candle is a small green (bullish) candle, showing that buyers are in control.

- Engulfing Red Candlestick. The second candle is a larger red (bearish) candle that completely engulfs the body of the first green candle. This indicates a shift in market sentiment, with selling pressure potentially overpowering the buyers.

- Shifting Market Sentiment. The bearish engulfing pattern suggests that bears gain control after a bullish rally, signaling a potential downtrend.

How to Trade the Bearish Engulfing Pattern

To effectively trade a bearish engulfing pattern, follow these steps:

- Identify the Uptrend. Look for a clear uptrend characterized by higher lows and higher highs.

- Spot the Engulfing Pattern. After a small bullish green candle, look for a larger red bearish engulfing candle. This suggests a shift from bullish to bearish sentiment.

- Confirm the Pattern. Ensure the bearish reversal is supported by higher trading volume on the red engulfing candle, indicating stronger selling interest.

- Enter the Trade. Once confirmed, you can enter a short position, expecting a price decline. To manage risk, place a stop-loss order above the high of the second green candle to limit potential losses if the downtrend fails to materialize.

Engulfing candlestick patterns are powerful indicators for spotting potential trend reversals in the financial markets. Whether you’re looking for a bullish reversal after a downtrend or a bearish reversal following an uptrend, these patterns offer clear signals for entry points. However, it’s important to use confirmation, such as increased volume or other technical indicators, to strengthen your trades. By mastering the engulfing pattern, you can better anticipate market shifts and exploit profitable opportunities. Remember to implement proper risk management techniques and only trade with a well-thought-out strategy.